Flatter Than the Patriot’s Offense If you struggled to stay awake during Sunday’s Super Bowl, you weren’t alone. The game was a defensive stalemate that lacked any real spark—a sentiment that, unfortunately, seems to be spreading to the U.S. economy. Much like the teams on the field who seemed content to punt rather than push …

February 4, 2026 – Punxsutawney Phil saw his shadow on Groundhog Day this week, forecasting 6 more weeks of winter. Phil’s accuracy is only about 30% over the past decade and about 39% dating back to 1887, but it rivals more sophisticated models. This week the technology sector caught a chill, although other sectors of the stock market are starting to thaw out.

Déjà Vu All Over Again In the movie Groundhog Day, actor Bill Murray is forced to repeat the same wintry day in Gobblers Knob, PA waiting for a groundhog to forecast the future. January would not be a bad month to repeat as major stock indexes moved into positive territory. Yesterday, not so much. Software …

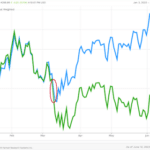

January 28, 2026 – Supported by the upcoming “One Big Beautiful Bill Act” (OBBBA) fiscal stimulus and broadening earnings growth, the first half of 2026 offers a favorable market backdrop even as Big Tech faces intense scrutiny regarding tangible AI returns. However, we anticipate conditions will become more challenging later in the year, as the accumulation of lofty consensus earnings expectations and potential macroeconomic friction creates a riskier environment for investors.

Clear Skies for Now, But Clouds on the Horizon As the East Coast begins to clean up from the recent winter storm, investors are assessing the visibility for the year ahead. The market outlook for the first half of 2026 appears relatively clear, bolstered by stabilizing earnings and anticipated fiscal support. However, while the immediate …

January 21, 2026 – The “Sea of Tranquility” on Earth’s Moon was the site of the historic Apollo 11 landing in July of 1969, marking humanity’s first steps on another celestial body. The area was named for its seemingly calm, dark plains and potentially smooth landing potential. We started out the new year in a relatively tranquil phase for markets, but that has faded for now as new tariff threats have emerged. Hopefully, this is resolvable and short-lived, but bond yields around the world are backing up leading to a pullback in equity markets.

Houston, We Have A Problem We are coming off of three years in a row of strong stock market returns and a solid start for equity markets worldwide in early January. As of last week, the average volatility across US bonds, equities and the dollar over the past month had sunk to the lowest since …

January 14, 2026 – Following a strong, three-year bull market, we view the start of 2026 as a pivotal shift where sticky inflation, mixed earnings, and rising geopolitical tensions are replacing the era of easy, momentum-driven gains. While the near-term economy remains resilient, the market will need to see confirmation in upcoming earnings releases to continue its march higher.

A Shift in the Landscape As we begin 2026, following what has been a remarkably strong three-year bull market, I wanted to share my perspective on the changing environment. The easy gains of the recent past have set a high bar, and while the rearview mirror looks fantastic, the road ahead is becoming far more …

January 7, 2026 – 2025 ended up as the third year in a row of strong stock market returns. The new year has also seen a solid start for equity markets worldwide after markets drifted lower toward the tail end of 2025. 2026 will be a convergence year. It marks the 250th anniversary of the founding of the United States, the 100th anniversary of the founding of Route 66, and a Chinese New Year cycle that has not been seen in 60 years. If inflation, interest rates and corporate earnings converge on a favorable path, we could see solid market returns for the full year, although there are also several potential potholes to navigate.

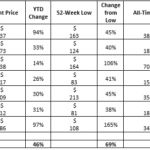

A Solid Start to 2026 The S&P 500 finished 2025 with a 17.9% total return for the year, while the equal-weighted index posted an 11.4% total return. That is better than the average stock market return of 10% over the last 100 years, which amounts to about 7% adjusted for inflation. Alphabet# (Google’s parent), led …

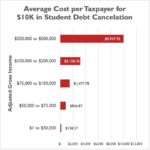

December 29, 2025 – It is customary at the end of every year to look ahead. As I say all the time, the critical factors influencing stock prices are earnings, interest rates and the pace of inflation. Overall, consensus expectations are for earnings to increase close to 14%, inflation either slightly lower or slightly higher than we have experienced this year, and lower Fed Funds rates given that Trump is not likely to appoint anyone to be the next Federal Reserve chairman who won’t pursue a steady downward path. The combination of lower rates, modest inflation and higher earnings should be a favorable backdrop for stocks. With that said, I want to make some specific observations that may texture how the economy and the stock market act next year.

Earnings Expectations: 14% growth seems a bit high. If I assume nominal GDP grows 6-8%, that assumes margins expand notably from already high levels. Lower taxes, some productivity improvement and a smaller regulatory burden suggest higher margins. But 14% earnings growth sounds a bit aggressive to me. Labor: Excluding gains of over 600,000 in the …

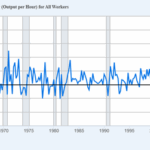

December 22, 2025 – All the hype suggests artificial intelligence is going to be a game changer as far as productivity is concerned. But history suggests that may not be correct. While technology has been the driver of 2-3% productivity gains over the last 75 years, inventions like mainframe computers, PCs, smartphones, networking and the Internet barely moved the productivity needle. What they all did was reduce the costs of doing business. Thus, technology drives both productivity and deflation. But where AI is set to accelerate, either trend is open to debate.

Last week I noted that the impact of Federal Reserve policy, under new leadership, is likely to be the single most important driver of economic and stock market performance in 2026. Tell me the yield on the 10-year Treasury at the end of next year and I could likely draw a pretty accurate picture of …

December 18, 2025 – The AI bubble hasn’t burst; it has matured, violently purging speculative “tourist” capital to make room for battle-tested business models that actually generate cash. While the job market falters and the Federal Reserve retreats, the real opportunity lies in ignoring the short-term carnage to focus on companies with the competitive moats necessary to dominate this new industrial order.

In recent weeks, the market has experienced a distinct recalibration, moving away from the unbridled optimism that characterized much of the year. The primary driver of this shift has been a significant downturn in AI-related stocks. Heavyweights in the sector have faced sharp declines, with some leaders in the semiconductor space shedding more than 20% …

December 15, 2025 – The Fed’s expected decision to lower rates by 25 basis points was totally expected, and therefore, not market moving. As to the future, the path forward for the Fed can’t be well defined until a new Chairman is named and confirmed. The Powell Fed was marked by caution and high attention to inflation trends. The next regime could well be more growth focused and willing to tolerate slightly higher inflation, at least for a time. Whether markets are enthusiastic or not may well dictate how equity markets react.

Last week’s Fed meeting was a non-event as the stock market’s instant positive reaction was reversed Friday. Fed Funds rates came down 25 basis points as virtually everyone expected, and Chairman Powell suggested that future cuts would be more spread out over time. But Powell is a lame duck and disparities of opinion among present …

December 11, 2025 – Formula One racing crowned a new world champion over the weekend. The race tracks involve fast straightaways followed by tight curves, and sometimes drivers veer off the track. Stock markets this year started out fast out of the gate, but then hit some serious curves in the first few months. Since then, it has been a relatively strong run to a 17% gain for the S&P 500 and a new record. The Federal Reserve reduced interest rates further yesterday, reducing the drag on the economy and suggesting some progress on the inflation front.

A Photo Finish The battle for the Formula 1 (F1) drivers’ championship went down to the season’s final day this past weekend after 24 Grand Prix races. Even after a third-place finish in the Abu Dhabi race on Sunday, Lando Norris of team McLaren beat the four-time champion, Red Bull’s Max Verstappen, to claim the …

December 8, 2025 – Despite a Fed that seems disjointed and ongoing tumult in Washington, markets jogged ahead. If the basis for stock prices are earnings, interest rates and long-term inflation expectations, there is no reason to back out of the market. While headline numbers of tech stock nirvana suggest risks, the average stock this year was up close to 10%, hardly a euphoric reaction to a volatile economic year. Until expectations decline, stocks should do fine.

This week, I want to discuss three topics: the economy and its impact on the stock market for 2026, affordability, the word that has emerged as a leading focus within our political lexicon, and the Fed which meets this week to discuss the future course of short-term interest rates. I will tackle each in reverse …

December 4, 2025 – Although third-quarter corporate profits surged on the back of AI efficiencies, a sharp economic bifurcation is emerging where dominant market leaders thrive while Main Street struggles and the broader economy cools. The Federal Reserve’s pivot provides critical liquidity, yet we anticipate continued volatility and an accelerating “winner-take-all” environment where profit growth concentrates in tech-savvy giants despite slowing overall activity.

The “Winner-Take-All” Divergence The headline numbers from the third quarter present a compelling picture of corporate resilience. Earnings growth surged nearly 13%, handily beating the consensus expectation of 8%. Yet, the S&P 500’s reaction has been measured, with the index up a modest 1.8% quarter-to-date. This restrained market response, despite a double-digit earnings beat, suggests …

December 1, 2025 – This week will see the release of economic data delayed by the government shutdown. But it won’t be up to date data. That will come later this month. But all signs seem to indicate an economy chugging along at a measured pace with inflation still above target. Against that backdrop, the Fed appears likely to continue lowering rates providing further stimulus. With that said, there are few storm clouds mostly related to speculative and aggressive investing. This doesn’t seem to be the moment to take added risk. As Jim Cramer has said, bulls make money, bears make money and pigs get slaughtered.

A late week rally resulted in the seventh straight up month for the S&P 500. However, the 1.5% drop in the NASDAQ broke the seven month rise in that index. Data over the weekend suggested strong Black Friday sales, an encouraging sign that the economy is still growing. It could even accelerate in the first …

November 24, 2025 – Market corrections can begin for almost any reason. This one’s birth was originated by fears that the AI hype got too extended, and in some cases, built on a base of too much debt. A rush to risk averse assets also sent bitcoin into a tailspin, perhaps causing those owning too much bitcoin on leverage to sell other assets including equities. Yet the economy chugs along showing no signs of a recession. Thus, we appear to be in the midst of a valuation correction, one that still may take a while to run its course.

Balance. When everything is in balance, you achieve stability. Put two people of exactly equal weights on opposite ends of a seesaw and both will hover over the ground. In the economy, balance happens when supply equals demand. In our labor market, enough new jobs have been created to roughly match the growth in the …

November 20, 2025 – The last penny was recently minted in Philadelphia where the first one was minted over 230 years ago. The problem is that it now costs over three times more to make a penny than it is worth. There have been concerns that artificial intelligence data centers and infrastructure are also consuming more resources than the payoff may be worth. The technology sector has been declining over the past couple of weeks on these concerns. Nvidia allayed fears of a near-term AI bubble with positive guidance for the fourth quarter last night, although recent earnings reports from several retailers add to a cloudy overall economic outlook.

A Penny Saved “A penny saved is a penny earned” is a phrase often attributed to Benjamin Franklin, who wrote in his 1737 Poor Richard’s Almanack, “A penny saved is two pence clear.” Close enough. The U.S. Mint said in its annual report that each penny costs 3.69 cents to make. Even though the U.S. …

November 17, 2025 – Last week saw massive rotation out of technology leaders into value stocks long forgotten in this year’s rally. Tech investors were spooked by a growing chorus of concerns around circular investing and stretched balance sheets. Some of the fears are real and some probably exaggerated. Given the strong performance over the last two years, some consolidation was clearly called for. Is the correction over? There certainly hasn’t been any panic or capitulation yet. If one looks closely, the big companies doing the best, experienced only modest declines in their stock prices. Those whose promises might have been exaggerated started to pay the price. That purge probably has more room to go.

It was an eventual week. The government shutdown was brought to a close. On Wall Street it was a week of rotation with money rotating heavily out of many tech names into areas of the market that couldn’t catch a bid for months or even years. Health care stocks, for instance, had their best week …

October 27, 2025 – With President Trump making news overseas, and Canada facing more tariffs, Wall Street will focus on the earnings of five big major tech companies this week. In the short-term, meaning between now and year-end, the prospect of continued solid earnings and lower short-term interest rates should keep stocks moving higher. But there are always warning signs. The biggie is debt. Too much debt burst the balloon in 1929 and again in 2008, the two biggest calamities of the last century. Debt levels aren’t quite threatening yet but they are moving in the wrong direction and bear watching.

For the past two weeks I have been traveling in Europe. The continent is an economic mess. Yes, tourism is strong and, on the surface, all seems vibrant. But in most cases, governments are in tenuous states attacked from both the left and right. Regulations and an inability across the Eurozone to reach consensus on …

August 25, 2025 – The Fed’s shift in policy, as stated by Jerome Powell last Friday, moves away from a focus on inflation and more toward insuring full employment. Such a shift suggests more short-term rate cuts and a willingness to tolerate some inflation as long as it stays below 3%. A willingness to tolerate a bit more inflation may sound innocuous but it could lead to unanchored long-term inflation expectations and keep 10-year Treasury yields elevated. If so, the euphoria expressed in Friday’s market rally may have been a bit too exuberant.

For the first four trading sessions last week, there was a decided shift away from momentum stocks and away from the perceived AI beneficiaries. That all flipped on Friday after Federal Reserve Chair Jerome Powell spoke on Friday at Jackson Hole and indicated a shift in policy within the Fed. Markets soared, interest rates declined …

August 21, 2025 – This Friday we will receive commentary from the Federal Reserve after its annual gathering in Jackson Hole, Wyoming. The central-bank gathering has sometimes been a venue for marking shifts in Fed policy. Last year Fed Chairman Powell used it to signal that rate cuts were coming, and followed through the next month. The Snake River, which runs through Jackson Hole, provides an apt backdrop for the Fed’s meeting where the waters can be turbulent and winding. In the meantime, technology stocks have retreated this week and a number of consumer-focused companies have provided both encouraging and uncertain signals.

A River Runs Through It Last year at the Jackson Hole Economic Symposium, Federal Reserve Chair Powell indicated that the Fed would begin cutting interest rates at its next meeting, which occurred in September 2024. Powell stated that “The time has come for policy to adjust,” and that the “direction of travel is clear”. He …

August 18, 2025 – The noise of front-page news doesn’t seem to coincide with record stock prices. War, ICE raids, violent storms and tariffs may be the topics of the Sunday talk shows, but the stock market cares more about earnings and interest rates. Earnings are rising and interest rates are stable. Will that continue? Earnings growth should slow a bit as the full impact of tariffs hits. While the Fed Funds rates should start to decline this fall, markets will focus on changes in the 10-year Treasury yield more than the Fed Funds rate.

Reading the headlines, it is hard to square the circle between all the bad news we read about on the front pages and record stock prices. Tariffs, wars, rising commodity prices, ICE raids, and difficulties many have finding jobs doesn’t seem to jive with record reported profits. But investors aren’t crazy. So, let’s dig a …

July 17, 2025 – Stocks rebounded after President Trump clarified his stance on Federal Reserve Chair Jerome Powell. While consumer and producer price indexes suggest some inflation moderation, particularly in services, certain tariff-exposed goods continue to see price increases. Despite these pressures, the U.S. economy shows underlying strength, exemplified by strong bank earnings and robust consumer spending, though the long-term impact of escalating tariffs remains a key uncertainty.

Market Volatility The U.S. stock market experienced volatility on Wednesday, initially dropping before recovering, largely influenced by remarks from President Trump regarding the Federal Reserve Chair Jerome Powell. Reports surfaced that Trump might attempt to remove Powell, causing the major indexes to tumble. However, stocks rebounded after Trump denied these plans, with the S&P 500 …

May 30, 2025 – Amidst a volatile market, significant economic risks such as high interest rates and trade policy are creating a tense environment where stock market gains may be capped. Key sectors, like housing, are already showing signs of strain from elevated rates, while the bond market remains turbulent. Therefore, a diversified and defensive investment strategy is recommended, emphasizing fundamental analysis and valuation discipline for stocks while holding high-quality bonds to navigate the expected volatility.

2025’s Crosscurrents: Markets in tension The current investment landscape presents a series of complex and often conflicting signals. While the S&P 500 has impressively recovered to within 4% of its February highs, a palpable sense of tension remains present. This environment is characterized by a tug-of-war between persistent economic risks and resilient asset prices, creating …

March 27, 2025 – A couple of weeks ago, NCAA college basketball March Madness was just getting underway. After several surprise upsets and some chaos among millions of brackets, we now know which teams are in the Sweet Sixteen final games. Over the past 40 years, only three men’s teams have had a long streak of winning years making it into the finals. As in the stock market, last year’s darlings may not be this year’s victors, but good companies can reinvent themselves and market volatility can work both ways.

More March Madness Tariff policy has been dominating headlines and impacting market volatility this year. The Magnificent 7 technology stocks had rebounded the last few days, but fell 3% yesterday on a day in which the Nasdaq declined 2%. This volatility has been mostly due to the potential inflationary effects of new tariffs and concerns …

December 19, 2024 – The Federal Reserve lowered its key interest rate by a quarter percentage point yesterday, but signaled that only two more rate cuts may be coming in 2025 instead of the four cuts widely expected. Fed Chairman Powell said it is like “driving on a foggy night or walking into a dark room full of furniture: you slow down, you go less quickly.” That hawkish and more uncertain tone was not well received by markets. While the stock market is typically volatile on Fed decision days, the 10-year yield backed up to 4.5% and stocks dropped about 3% following the Fed’s remarks. Markets have been strongly positive this year, but a pause on this news provides a chance to focus on better valuations. Stock market futures are indicated positively this morning.

Fed Meeting – Driving on a Foggy Night The Federal Reserve lowered its key interest rate by a quarter percentage point yesterday, the third consecutive reduction. This brings the total reduction to 1% since the Fed began cutting rates in September. The rate cut to a target range of 4.25%-4.5% is back to the level …

August 12, 2024 – Last week’s volatility exposes the heightened level of uncertainty in today’s financial markets. This week, the largest retailers report earnings and may offer some clarity into consumer spending trends. But uncertainty is likely to remain elevated until we get closer to the November elections.

Roughly 75% of the time, stocks go up. They go up because earnings rise. They don’t go up in a straight line for obvious reasons. Interest rates fluctuate. Central bank actions are impactful. With that said there are periodic bear markets. While occasionally they represent a correction of a severely overvalued market, most bear markets …

December 8, 2023 – Markets rallied yesterday but remained in tepid anticipation of today’s employment report and next week’s CPI report. The November employment report came in close to expectations with gains of 199,000. Not sure from the early read how much those numbers were enhanced by the end of the auto and Hollywood strikes. Markets reacted negatively to the report as month-over-month wages increased slightly more than anticipated. The unemployment rate fell to 3.7% as the labor participation rate rose to a pre-pandemic high.

Stocks rallied yesterday while bonds stayed mostly level in front of next week’s Federal Reserve meeting. For a change, the leaders were the big tech stocks, noticeable laggards over the last four weeks during a period where investors moved toward equities perceived as being cheaper than the high multiple Magnificent Seven. The pop in the …

September 18, 2023 – Markets are directionless, torn between better economic activity and an increase in storm clouds from labor unrest to China. What is crucial is the future trend for interest rates. Investors will parse this week’s FOMC meeting for clues, but probably won’t get a much clearer picture for their efforts.

Stocks have been trading sideways in a directionless pattern for the past month. On the plus side, earnings have exceeded forecasts and the economy continues to grow at a rate faster than economists had predicted. But that has been countered by a series of concerns: 1. Interest rates, particularly at the long end of the …

June 12, 2023- : The S&P 500 traded into Bull market territory last week on the back of a broad market rally. The broadening of the rally is key to continued optimism in the market. However, the possibility of a recession still looms, despite the rally.

Are we in a new Bull market? Last week the S&P 500 rallied to its highest level this year which put the index 20% above its October lows. On a year-to-date basis the index is up 12% led by mega-cap technology stocks. However, as we mentioned many times before, not all stocks and sectors have …

May 12, 2023 – While mega caps keep gaining steam, the average stock is now down for the year. Eight of the last nine trading sessions have been negative for the Dow Jones Industrial Average. The Fed may be done raising rates, but an all-clear signal is far off in the distance. Transitions are hard!

April’s consumer inflation report was well received, with a continuation of a gradual slowing for inflation. Ditto for the Producer Price Index yesterday morning. Our infamous “Fed whisperer”, Nick Timiraos, helped fuel a minor rally in growth stocks when his latest Wall Street Journal missive noted “Federal Reserve officials were already leaning toward taking a …

April 26, 2023 – Markets are being buffeted by crosscurrents. The banking crisis has come back into focus amid turmoil at First Republic. Earnings reports move individual stocks both ways. Bond market strength portends a weakening economy and slower inflation. Yet pockets of economic strength endure, mostly in the travel and leisure sectors. The net for equity investors is a standoff, one likely to endure for some time amid persistent rotation of leadership.

It was a wild day yesterday with several strong moves relative to earnings, a wild ride for First Republic Bank, the regional bank most people see as the stress point within the banking system, and a sharp rally in bonds. The major averages were all lower. After the close, solid earnings from Microsoft# reduced some …

October 26, 2022- Stocks have now risen sharply for three straight sessions as both the value of the dollar and the yield on 10-year Treasuries retreated. But disappointing earnings last night from a trio of tech names may spoil the party this morning. Or at least give it some reason to pause. The poor numbers from tech land remind us to look forward, not back. The great opportunities that technology created over the last quarter century are now maturing. The good news is that new opportunities will appear. They always do in a capitalistic entrepreneurial society.

Stocks rose sharply for the third straight session. It’s earnings season. Through yesterday, the results were basically in line with lowered expectations, but perhaps the biggest driver of higher stock prices was the reversals over the past several days in the value of the dollar and the yield on 10-year Treasuries. Within a bear market …

October 12, 2022- As we enter earnings season, attention will shift from interest rate fears to corporate performance. Pepsi kicked it off this morning with good results, hopefully an encouraging sign. As always, the story for the season will revolve around expectations versus reality. In July, reality beat expectations sparking the best rally of the year. The key will be the relative performance of the large tech names, notable laggards coming into earning season.

Stocks ended mixed yesterday in a very volatile session where the Dow Industrial Average moved back and forth by more than 1000 points. News was rather sparse. A brief afternoon plunge occurred after the Bank of England signaled it would halt its planned intervention to support the pound Friday as originally planned. Stock, bond, and …

October 5, 2022 – Two huge up days in a row put bulls back in charge. Is this the market bottom? Only time will tell. It will largely depend on the severity of the pending economic downturn. But retreating interest rates, and weaking labor market statistics suggest the end to the Fed’s cycle of higher interest rates is nearing an end. That is at least one key ingredient to the end of a market downturn.

For those of you who have read my letters over the years, you should know about my 2-day rule. It states that two consecutive days of outsized moves in the opposite direction of recent market trends marks a reversal. Certainly, the gains Monday and yesterday qualify as strong up sessions in sharp contrast to the …

August 26, 2022 – Markets continued to consolidate the ~20% spike off June’s low with minor rebounds the past few days. In anticipation of Chairman Powell’s long-awaited speech at Jackson Hole today, stocks are priced for a somewhat hawkish update. Anything that deviates from that position could release energy in either direction. Other news items require some attention as well that could affect GDP going forward.

Stocks staged a late day rally to help bring all 11 S&P sectors to a positive close yesterday. Gains were led by Basic Materials, Technology, and Communication stocks. The risk-on tone had defensive sectors lag the overall market with Utilities, Consumer Staples and Health Care stocks fractionally higher. Rallies continue to follow the Treasury market. …

June 13, 2022 – Friday’s report on Consumer Prices told us all that the fight against inflation will be harder than previously anticipated. This week, the Fed will increase interest rates again. It may suggest the ultimate Fed Funds rate this cycle will need to be higher than previously thought. None of this is good news for equity investors.

Friday’s CPI report didn’t make investors happy. Led by sharply higher energy expenses, and the fastest growing shelter costs in decades, the message loud and clear was that inflation shows no signs yet of abating. Recognizing that government steps to curb inflation only began in March, the numbers we are seeing now weren’t impacted one …

May 25, 2022 – While the Dow tries to find its footing, the NASDAQ continues in steep decline as one former darling after another faces reality. It’s an ugly picture and it isn’t over for the speculative end of the market. for those looking for safer havens, more dependent on predictable cash flow growth, the picture is far better. The contrast between the two worlds was most evident yesterday.

Stocks fell once again although a sharp afternoon rally reduced the damage. Still, the NASDAQ fell another 2.4% after a prominent social media company lowered earnings guidance just a month after it previously offered a somber outlook. As a group, social media and related companies depend on advertising for revenue. With the economy slowing and …

May 2, 2022- When leadership gets taken out to the woodshed, the whole market dies. That is what happened last week. While some escaped (e.g., Microsoft) the loud and clear message is that the big boys of the S&P 500 are now at or near economic maturity. That isn’t a message a market already worried about interest rates and recession wanted to hear.

Stocks sank on Friday to close out one of the most miserable months for equities in many years. The NASDAQ took it on the chin the worst after Amazon# reported a weaker than expected outlook for its retail business when it reported results Thursday night. On Friday, Amazon# suffered its worst percentage loss since the …

March 25, 2022 – Investors continue to grapple with inflation, war news, Fed tightening and valuations. Historians will point to stocks not topping until earnings peak, inversion occurs and/or better alternatives. We got some answers over the past few weeks but cloudiness prevails, for now.

A few weeks ago, there were almost no positives to think of. Most investment advisors were bearish. Cash was sitting on the sidelines earning nothing. Short sellers were pressed. Russian invasion continued to look worse by the hour. Oil, wheat, natural gas and many other commodities spiked higher even after doubling since Covid. The most …

March 21, 2022- The Fed did what it said it would do, economic growth remains intact, and the war isn’t getting worse by leaps and bounds. That set the table for a strong rally in stocks. Is the bottom in? Or is this just a bounce? The answer may be a little yes and a little no. For some stocks, the bounce might be over, but if the economy stays solid, there remain plenty of opportunities.

Stocks rose sharply all week as the NASDAQ rebounded out of bear market territory and both the Dow and S&P 500 cut their 2022 losses roughly in half. Oil prices remained volatile closing at over $100 per barrel. Pain at the pump continues but it isn’t getting worse, at least for now. Interest rates rose …

March 7, 2022 – While the war outcome continues down a path leading to a Russian occupation of Ukraine, the economic costs are becoming both starker and more apparent. Gasoline prices are rising close to $0.50 per week. If anything, the pace is accelerating. Wheat, aluminum, copper and palladium are spiking as well. These root commodity price increases will flow into a massive array of products. Inflation is quickly becoming more supply constrained than demand driven. The Fed’s weaponry can’t increase supply.

Stocks fell last week for the fourth week in a row, a combination of inflation fears and the war in Ukraine. Bond yields fell amid a flight to safety. The news from Ukraine is discouraging, to say the least, but it isn’t unexpected. Russia has overwhelming military advantages and continues to make progress in its …

January 10, 2022 – If there was a message last week, it was that speculative fever is dissipating as the Fed winds down its pace of bond purchases. No one knows when the purging of speculation will end but it probably will be with a thud, not a whimper. Market rotation to financials, industrials and energy names suggests the economy continues to thrive despite Omicron. The rotation can go a bit farther. The high growth sector got very overpriced, outpacing cyclical and value stocks for years, and it could take several more months for the rotation to run its course, allowing for some intermittent bounces and reversals. The overall market is down only modestly as the speculative fringes blow apart.

It was a tough week for stocks particularly on the NASDAQ. The speculative end of the market took the biggest hit as bond yields rose in line with continued economic growth. I noted last week the relevance of the January barometer. While not always valid, there is a trend that says, “as goes January, so …

October 11, 2021 – Markets remain volatile as growth slows, interest rates rise, and Washington politics remain a mess. Until supply chain problems are resolved the picture is unlikely to change. Demand is strong but much of it is unfilled. Perhaps it is time for Washington to take notice.

Stocks gave up some ground on Friday but still finished the week with decent gains. Trading remained volatile. Leadership rotated between growth and value stocks several times depending on the economic news of the day and trends in interest rates. The week ended with 10-year Treasury yields crossing the 1.60% barrier for the first time …

October 4, 2021 – A tough September is not a harbinger of what’s to come. The Delta variant is fading, and interest rates are not likely to rise as fast as they did in September. Inflation concerns remain. However, that should mute future upside. Higher earnings, on the other hand, will mute the downside.

Stocks rallied at the end of a dismal September. While growth in September deteriorated a bit thanks to the persistence of the Delta variant of Covid-19, stocks fell due to a combination of issues, a slowdown in growth being just one. Interest rates rose, the Fed hinted at tapering bond purchases before year end, and …

October 1, 2021 – Concerns, they are aplenty. Markets ended September on a sour note, as major averages tested last week’s spike lows. The key to the next 5% move revolves around equities holding near current support levels. Near-term headwinds are compounding, pointing to more downside risk. Rest assured, this bull market is not over yet.

Another quarter is in the books as we enter October which historically has been a favorable seasonal time to be invested. This is especially true in years where stock market returns are already generous. History says we should expect a solid finish for 2021. Even after a nearly 5% drop across the board in September, …