This was the opening sentence from my letter last week. “Now that the Big Beautiful Bill has passed, attention will turn to the path forward on tariffs and to second quarter earnings that will start to be reported within the next two weeks.” How fast the reconciliation bill fades into memory amid all the tariff …

July 10, 2025 – Professional dodgeball exists in the form of the National Dodgeball League. The NDL was founded in 2004 and is the only professional dodgeball league in the US, sporting 24 professional teams. Investors, corporate management teams and our trading partners may feel like they are playing dodgeball this year due to shifting tariff policies. Market volatility has indeed been above average in the first half of 2025. So far, we have dodged a major economic slowdown, job losses or significant inflationary pressures from tariffs, although the second half of 2025 could witness a bounce in these metrics.

Did We Dodge DOGE? The five D’s of dodgeball, as famously quoted in the movie “Dodgeball: A True Underdog Story,” are Dodge, Duck, Dip, Dive, and Dodge again. These are the fundamental movements players use to avoid being hit by a thrown ball. In dodgeball, you win by not dropping your ball or by catching …

July 7, 2025 – Treasury Secretary Bessent talks of his 3-3-3 goals, 3% growth, 3% inflation and a reduction of the deficit-to-GDP ratio from over 6 to just 3. Those are mighty goals. The passage of the reconciliation bill may make short-term movement in the right direction but the ongoing buildup of debt may make reaching those long-term goals difficult.

Now that the Big Beautiful Bill has passed, attention will turn first to the path forward on tariffs and then to second quarter earnings that will start to be reported within the next two weeks. But before looking ahead, I want to discuss the implications of the new bill just signed into law. White House …

July 3, 2025 – The second quarter of 2025 delivered a stellar performance for U.S. equities, with impressive gains across major indices driven by strong corporate earnings, AI enthusiasm, and eased trade tensions. Despite this rally, the market successfully navigated challenges including early tariff anxieties, signs of consumer stress, and geopolitical uncertainties. Looking ahead, investors are keenly watching the “One Big Beautiful Bill Act” and its potential impact on interest rates, inflation, and corporate profitability.

The Second Quarter’s Grand Finale: A Market Fireworks Show As we celebrate the Fourth of July, the second quarter of 2025 delivered a truly spectacular performance for U.S. stocks. After a somewhat subdued start to the year, the market roared back with impressive force, illuminating portfolios with significant gains. The Dow Jones Industrial Average rose …

June 30, 2025 – Trump’s big beautiful bill is headed for the finish line. It isn’t done yet and likely will see further changes before it reaches his desk. As the administration buys the votes necessary for its approval, expect the impact on future deficits to rise. With that said, the bill will help to accelerate near-term growth. Second quarter earnings reports are just a couple of weeks away and they should be good. However, unlike Q1 when skepticism abounded, this time optimism is high. July is usually a good month for stocks but the sharp April-June rally may mute the pace of further gains.

The Senate appears ready to send its version of the “Big Beautiful Bill” (BBB) back to the House to either accept its changes or to make further modifications. While President Trump wants to see the bill on his desk for signature by Friday, there is a lot to do in four days for that to …

June 26, 2025 – Labubu dolls are hard to get these days. These dolls are prized by children in China, along with some celebrity admirers such as David Beckham and Rihanna. The grimacing, elvish-looking creatures come in “blind boxes” that keep buyers in suspense over which one they might get, but can take weeks to acquire. They sell for as little as $20, but a rare variety recently sold at auction for $150,000. In spite of all the hand-wringing about inflation and tariffs, consumers around the globe continue to spend. However, patterns of spending have definitely shifted.

I Will Gladly Pay You Tuesday… Inflation, trade wars, a growing fiscal debt burden, and geopolitical conflicts are serious concerns that have impacted investors this year. However, in spite of all the hand-wringing about inflation and tariffs, consumers around the world have continued to spend throughout the first half of this year, driving global GDP …

June 23, 2025 – Saturday’s bombing of Iran’s nuclear sites was shocking news but financial markets are taking the news in stride at least until they can assess the Iranian response. Economically, little has changed so far. The one elevated risk would be an attempted blockage of the Strait of Hormuz. While possible, that would be a very dangerous escalation that would evoke a powerful response. Markets, at least for now, place low odds of that happening. Thus, the economic impact of the raid so far is marginal and markets remain calm.

The obvious big story over the weekend was the U.S. strike on Iran’s nuclear facilities. While the White House hailed the strike as a complete success, full assessment of the damage awaits more facts. While Iran could do nothing in response and capitulate to U.S. demands to curtail any thought of building a bomb, few …

June 16, 2025 – While many in Congress fret that the reconciliation bill now before the Senate raises deficits and ultimately leads to economic disaster if left unchecked in the future, the focus will be on now. That means lower taxes, faster growth and higher earnings in the short-run as long as the bond market doesn’t rebel. Only a true crisis is likely to elicit fiscal austerity. That won’t happen before the current bill, slightly modified, will pass. Wall Street will embrace it because it always embraces stimulative policy, at least until the side effects kick in. Markets are starting to replace complacency with euphoria. That can last many months. But as we learned from the SPAC debacle in 2021, it won’t last forever.

Contradictory goals create tension. Look at immigration policy. The stated goal to increase arrests to 3,000 per week is in conflict with the goal to allow farms, landscapers and construction sites to keep and maintain work forces necessary to maximize production. Tension can only be released if a happy median can be found. Within the …

June 12, 2025 – Despite a resilient stock market grinding near all-time highs, a fresh wave of geopolitical risk and fiscal policy uncertainty is creating headwinds. A chorus of Wall Street’s most respected investors is sounding the alarm, warning of dangerously high valuations, an unsustainable U.S. debt burden, and the rising probability of an economic slowdown.

A Market That Refuses to Quit Despite a drumbeat of anxieties, the stock market has been on a remarkable run, continuing its relentless grind higher and hovering just shy of all-time highs. It’s a classic bull-market climb, but this week, the ascent was checked by a fresh wave of geopolitical jitters. Renewed tensions in the …

June 9, 2025 – This week the focus will be on trade negotiations with China and the progress getting the Big Beautiful Bill on the President’s desk. The former is likely to be complicated and slow moving, but any movement in the right direction should keep investors happy. As for the legislation, it will be inflationary and worrisome long-term if one focuses on future debt service requirements. But this market has heard wolf cried too often to care until either interest rates spike higher or the dollar comes under renewed attack.

If the Trump Presidency can be summed up in one word, perhaps that word is transactional. Every step is viewed as a transaction, not just monetary. But there is always a winner and a loser. Win-win isn’t normally in his playbook. Obviously, the Presidency is multi-faceted. And because of that fact, often various steps can …

June 5, 2025 – The Old Faithful Geyser in Yellowstone National Park erupts regularly, but not on an exact schedule. Considering the most recent 100 eruptions, the average time between eruptions ranged from 55 minutes to over 2 hours. Likewise, inflation and employment data can cause ebbs and flows in the bond market, creating volatility for investors. Economic data are currently coming in mixed, mostly related to changing tariff policy. Meanwhile, equity markets are slightly positive so far this year, and only off about 3% from all-time highs.

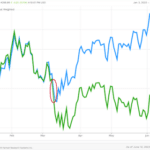

April Was A Sinkhole, May Was A Geyser May was a rebound month from a poor April showing in the stock market, with the S&P500 rising 6.2%. This marked one of the best May periods since 1990. “Sell in May and go away” has not worked as a trading strategy this year. Year to date, …

June 2, 2025 – Just as the Soviets laid down the gauntlet in the 1960s starting the space race, China has caught up to us technologically in many ways and is still gaining ground in others. For the U.S. to maintain its leadership requires coordinated efforts from both the private and public sectors. Trying to erect barriers is not a winning formula. Rather, properly focusing resources to support the most strategic initiatives makes sense.

In the fall of 1957, the Soviet Union launched Sputnik I, the first satellite to reach orbit. Four years later, Yuri Gagarin became the first astronaut to orbit the earth. The U.S. had been left behind. President Kennedy initiated a full court public-private press to catch up and reclaim American superiority. It was a true …

May 30, 2025 – Amidst a volatile market, significant economic risks such as high interest rates and trade policy are creating a tense environment where stock market gains may be capped. Key sectors, like housing, are already showing signs of strain from elevated rates, while the bond market remains turbulent. Therefore, a diversified and defensive investment strategy is recommended, emphasizing fundamental analysis and valuation discipline for stocks while holding high-quality bonds to navigate the expected volatility.

2025’s Crosscurrents: Markets in tension The current investment landscape presents a series of complex and often conflicting signals. While the S&P 500 has impressively recovered to within 4% of its February highs, a palpable sense of tension remains present. This environment is characterized by a tug-of-war between persistent economic risks and resilient asset prices, creating …

May 27, 2025 – The House has passed Trump’s big beautiful bill and moved it on to the Senate. It’s a budget buster that offers something for all but will expand deficits meaningfully. It’s a bit of a mess that can be fixed if the Senate has the backbone to fix it. Wall Street will be watching, especially bond investors.

More Whack-a-Mole. President Trump, frustrated with the pace of trade talks with the EU, announced 50% tariffs by June 1 if insufficient progress wasn’t made. Within 48 hours that deadline was stretched to July 19th. And if it has to be modified again, it most likely will happen given that 50% tariffs will essentially halt …

May 22, 2025 – Memorial Day Weekend is typically the unofficial start of summer for many. However, this year has been anything but typical. Corporate earnings have been holding up based on recent company reports and outlooks. Tariffs have dented a few earnings reports, but the consumer continues to spend. Credit spreads are not indicating a recession yet, although interest rates have been on the rise as Congress works on a spending resolution bill. Markets gave back some of their recent gains yesterday but are still only about 5% from their all-time highs. Not quite bear market territory. Anyone traveling this weekend to a national park should remember to bring their bear spray.

Keep Your Bear Spray Handy Anyone that has hiked in a national park, such as Yellowstone, knows that you have to bring bear spray with you. You may never see a bear and have no reason to utilize the bear spray, but it is a must-have in your arsenal. Similarly, portfolio diversification is important to …

May 19, 2025 – Stocks have clawed back all their post-Liberation Day losses as the perceived impact of tariffs have lessened. But now comes the hard part. Whatever tariffs are imposed will have economic consequences that we are only just starting to see. The big tax bill as originally proposed is a budget buster. 10-year Treasury yields are now back above 4.5%. With hindsight equity investors overreacted after Liberation Day. The subsequent rally may have gone too far as well.

Stocks have now recouped all their post-Liberation Day losses. The recovery started as soon as Trump backtracked from his reciprocal tariffs within 48 hours of announcing them. Subsequent steps, including an outline of a trade deal with Great Britain, and a suspension of the lion’s share of Chinese tariffs for at least 90 days, set …

May 15, 2025 – Following a big rebound, the S&P 500 is flat YTD but trades at a high valuation of 23x forward earnings. Consumer spending faces headwinds from rising student loan defaults and a cooling housing market. While recession fears have eased, the economy is slowing and inflation trends remain uncertain.

Navigating a complex landscape The YTD period has presented a fascinating, and at times unsettling, picture for the equity markets. Despite a significant downturn in early April, the market has managed to make a complete rebound during the last four weeks, rising an incredible 18%. The S&P 500 finds itself essentially flat for the year …

May 12, 2025 – China and the United States have agreed to reduce tariff rates on each other by 115% leaving our tariff rate on Chinese goods at 30%. Since shortly after the shock of Liberation Day that sent equity investors into panic mode, there has been a gradual retreat from an overbearing tariff framework outlined that day. Today’s suspension of tariffs, pending further negotiations may not be a final step. But it comes right out of the Trump playbook that shoots for the moon first and then settles into a much more compromised reality later. While tariff negotiations continue not only with China but the rest of the world, investors can now focus on the next leg of the Trump agenda, tax cuts.

Fears of excessive tariffs peaked on Liberation Day in early April. Financial markets cratered based both on the excessiveness of the announced levies in addition to the irrational nature of the process to determine payments each country would make. That included a tariff on an unoccupied island, at least uninhabited by people. The economic pain …

May 8, 2025 – The Federal Reserve on Wednesday held its key interest rate unchanged in a range between 4.25%-4.5% as it awaits better clarity on trade policy and the direction of the economy. While uncertainty about the economic outlook has increased further, the Fed is taking a wait and see stance toward future monetary policy. Meanwhile, the S&P 500 Index has just about fully recovered its losses following the April 2nd “Liberation Day” when major tariffs were announced on U.S. trading partners. The bounce in risk assets is welcome, but we are still looking for white smoke signals showing that progress on inflation and tariffs is being made.

Federal Reserve Standing Pat The Federal Open Market Committee voted unanimously yesterday to keep short term interest rates stable at 4.25-4.5%. The Fed has now left rates unchanged for a third straight meeting and at the same level since December. The post-meeting statement noted how volatility and tariff gyrations are factoring into policy decisions as …

May 5, 2025 – Investors overreacted to Trump’s early tariff overreach but may have gotten a bit too complacent that everything is now back on a growth path. While there are few signs of pending recession, the impact of tariffs already imposed are just starting to be felt. So far, no trade deals have been announced although the White House claims at least a few are imminent. The devil is always in the details. Congress will start to focus on taxes. Conservatives may balk but there is little indication to suggest they won’t acquiesce to White House pressure once again.

April was a yo-yo month for equity investors. The first week was a disaster. Trump’s Rose Garden announcement of huge tariffs on worldwide imports shocked the economic world. By the end of the first week, equities were on pace for the worst April in a century. But the administration quickly backtracked leaving room for further …

May 1, 2025 – U.S. GDP unexpectedly contracted by 0.3% in the first quarter, the first decline since 2022, largely due to a surge in imports ahead of anticipated tariffs. Despite this GDP contraction, major tech companies like Alphabet, Microsoft, and Meta reported quarterly earnings, indicating continued strength in areas like advertising and cloud computing. However, concerns remain about the broader economic outlook due to uncertainty surrounding tariffs, potentially leading to higher prices, weaker employment, and a challenging environment for the Federal Reserve regarding inflation and interest rate policy.

Surprise GDP Decline and a Mixed Economic Landscape The U.S. economy unexpectedly contracted in the first quarter of 2025, with the gross domestic product (GDP) declining at an annualized rate of 0.3%. This marks the first such contraction since 2022. A primary factor in this downturn was a significant surge in imports, as businesses increased …

April 28, 2025 – Markets rallied as the Trump Administration suggested tariffs might be reduced against China and that ongoing negotiations with almost 100 countries are progressing, although no deals have yet to be announced. But even with tariff reductions, the headwind will still likely be the greatest in a century. So far, the impact is hard to measure as few tariffed goods have reached our shores. Early Q1 earnings reports show little impact through March, although managements have been loath to predict their ultimate impact. Stocks are likely to stay within a trading range until there is greater clarity regarding the impact of tariffs.

Finally, we had a good week in the stock market. After a rocky Monday, when investors fretted over possible consequences should Trump attempt to fire Jerome Powell, equities rallied over the next four sessions once Trump put to rest such a notion, and Treasury Secretary Bessent commented that 145% tariffs on China might not last …

April 24, 2025 – “Headache” is the official Journal of the American Headache Society. Europe and Asia have their own publications and consortia devoted to the study of headaches and pain. The incidence of headaches may have increased for those following the stock market gyrations over the past few months, though resolution of tariff issues would go a long way toward calming markets down. Eventually. Near-term impacts on inflation and the economy may create some pain points and additional volatility if consumers and businesses retrench.

Pain Points Swelling There are several medical journals devoted to the study of headaches and pain. “Headache” is the official Journal of the American Headache Society. The “Journal of Headache and Pain” is the official journal of the European Headache Federation. Not to be left out, Asia has their own Headache Consortium. The prevalence of …

April 21, 2025 – Tariffs raise barriers that make imports less desirable. They serve to reduce the balance of payments. But by protecting local producers of higher cost goods, they are inflationary. The attendant decline in the value of the dollar chases investment capital away, capital necessary if reshoring of manufacturing is going to be achieved. The goal of the Trump administration should be to find the balance that favors U.S. manufacturers but retains investment capital within our borders. So far, markets suggest that dilemma hasn’t been resolved.

Trying to distill policy to its essence, the Trump economic game plan is to eliminate the trade deficit on goods while bringing manufacturing back to the United States. The two goals are often in conflict with each other. One cure for a trade deficit is for the dollar to weaken, thereby making exports cheaper and …

April 17, 2025 – The Trump administration’s trade and tariff plans aim to improve trade for American businesses, primarily through the use of tariffs. However, initial market reactions have been contrary to expectations, with a weaker dollar and rising interest rates creating economic uncertainty. Investors should brace for potential recession and stagflation risks with balanced portfolios and a patient approach to future investment opportunities.

The Times They Are A-Changin’ This week, I want to talk about the Trump administration’s trade and tariff plans and what they could mean for the economy. In essence, the president is trying to change how we trade with other countries—and this has shaken the financial markets. Many of the ideas come from a 40-page …

April 14, 2025 – The tariff roller coaster ride continues as Trump exempts some tech products made in China from tariffs but warns that secular tariffs on semiconductors are likely soon. While bond yields this morning are slightly lower, the dollar continues to weaken as the world continues to adjust to economic chaos in this country. While the tariff extremes of Liberation Day may be reduced over the next several months, they still appear likely to be the highest in close to a century, a clear tax on the U.S. economy. Wall Street’s mood can change daily depending on the tariff announcement du jour but until markets can determine a rational logic behind the Trump economic game plan, volatility will remain elevated.

Trade deficits occur due to comparative advantage. For whatever reason, one party can produce a product at a lower cost than its trading partner. Maybe wages are lower in the producing country. Maybe one party has a surplus of natural resources the other needs. Maybe climate allows one country to produce what another cannot. There …

March 27, 2025 – A couple of weeks ago, NCAA college basketball March Madness was just getting underway. After several surprise upsets and some chaos among millions of brackets, we now know which teams are in the Sweet Sixteen final games. Over the past 40 years, only three men’s teams have had a long streak of winning years making it into the finals. As in the stock market, last year’s darlings may not be this year’s victors, but good companies can reinvent themselves and market volatility can work both ways.

More March Madness Tariff policy has been dominating headlines and impacting market volatility this year. The Magnificent 7 technology stocks had rebounded the last few days, but fell 3% yesterday on a day in which the Nasdaq declined 2%. This volatility has been mostly due to the potential inflationary effects of new tariffs and concerns …

December 19, 2024 – The Federal Reserve lowered its key interest rate by a quarter percentage point yesterday, but signaled that only two more rate cuts may be coming in 2025 instead of the four cuts widely expected. Fed Chairman Powell said it is like “driving on a foggy night or walking into a dark room full of furniture: you slow down, you go less quickly.” That hawkish and more uncertain tone was not well received by markets. While the stock market is typically volatile on Fed decision days, the 10-year yield backed up to 4.5% and stocks dropped about 3% following the Fed’s remarks. Markets have been strongly positive this year, but a pause on this news provides a chance to focus on better valuations. Stock market futures are indicated positively this morning.

Fed Meeting – Driving on a Foggy Night The Federal Reserve lowered its key interest rate by a quarter percentage point yesterday, the third consecutive reduction. This brings the total reduction to 1% since the Fed began cutting rates in September. The rate cut to a target range of 4.25%-4.5% is back to the level …

August 12, 2024 – Last week’s volatility exposes the heightened level of uncertainty in today’s financial markets. This week, the largest retailers report earnings and may offer some clarity into consumer spending trends. But uncertainty is likely to remain elevated until we get closer to the November elections.

Roughly 75% of the time, stocks go up. They go up because earnings rise. They don’t go up in a straight line for obvious reasons. Interest rates fluctuate. Central bank actions are impactful. With that said there are periodic bear markets. While occasionally they represent a correction of a severely overvalued market, most bear markets …

December 8, 2023 – Markets rallied yesterday but remained in tepid anticipation of today’s employment report and next week’s CPI report. The November employment report came in close to expectations with gains of 199,000. Not sure from the early read how much those numbers were enhanced by the end of the auto and Hollywood strikes. Markets reacted negatively to the report as month-over-month wages increased slightly more than anticipated. The unemployment rate fell to 3.7% as the labor participation rate rose to a pre-pandemic high.

Stocks rallied yesterday while bonds stayed mostly level in front of next week’s Federal Reserve meeting. For a change, the leaders were the big tech stocks, noticeable laggards over the last four weeks during a period where investors moved toward equities perceived as being cheaper than the high multiple Magnificent Seven. The pop in the …

September 18, 2023 – Markets are directionless, torn between better economic activity and an increase in storm clouds from labor unrest to China. What is crucial is the future trend for interest rates. Investors will parse this week’s FOMC meeting for clues, but probably won’t get a much clearer picture for their efforts.

Stocks have been trading sideways in a directionless pattern for the past month. On the plus side, earnings have exceeded forecasts and the economy continues to grow at a rate faster than economists had predicted. But that has been countered by a series of concerns: 1. Interest rates, particularly at the long end of the …

August 2023 Economic Update – Towering Deficits and a Ratings Downgrade; Do They Matter?

In this video, Tower Bridge Advisors’ Chief Investment Officer Jim Meyer discusses the economic effect of the rising Federal deficit and the unintended consequences that follow. Please watch as Jim provides some perspective on what this means to investors.

August 2023 Economic Update – Towering Deficits and a Ratings Downgrade; Do They Matter?Read More

June 12, 2023- : The S&P 500 traded into Bull market territory last week on the back of a broad market rally. The broadening of the rally is key to continued optimism in the market. However, the possibility of a recession still looms, despite the rally.

Are we in a new Bull market? Last week the S&P 500 rallied to its highest level this year which put the index 20% above its October lows. On a year-to-date basis the index is up 12% led by mega-cap technology stocks. However, as we mentioned many times before, not all stocks and sectors have …

May 12, 2023 – While mega caps keep gaining steam, the average stock is now down for the year. Eight of the last nine trading sessions have been negative for the Dow Jones Industrial Average. The Fed may be done raising rates, but an all-clear signal is far off in the distance. Transitions are hard!

April’s consumer inflation report was well received, with a continuation of a gradual slowing for inflation. Ditto for the Producer Price Index yesterday morning. Our infamous “Fed whisperer”, Nick Timiraos, helped fuel a minor rally in growth stocks when his latest Wall Street Journal missive noted “Federal Reserve officials were already leaning toward taking a …

April 26, 2023 – Markets are being buffeted by crosscurrents. The banking crisis has come back into focus amid turmoil at First Republic. Earnings reports move individual stocks both ways. Bond market strength portends a weakening economy and slower inflation. Yet pockets of economic strength endure, mostly in the travel and leisure sectors. The net for equity investors is a standoff, one likely to endure for some time amid persistent rotation of leadership.

It was a wild day yesterday with several strong moves relative to earnings, a wild ride for First Republic Bank, the regional bank most people see as the stress point within the banking system, and a sharp rally in bonds. The major averages were all lower. After the close, solid earnings from Microsoft# reduced some …

April 2023 Economic Update – The Banks, The Economy and Valuation

In this video, Tower Bridge Advisors’ Chief Investment Officer Jim Meyer discusses three key topics impacting investors – Banks, the Economy and Valuation. Please watch as Jim provides some perspective on these topics and gives investors some sense of how to position portfolios for what lies ahead.

April 2023 Economic Update – The Banks, The Economy and ValuationRead More

October 26, 2022- Stocks have now risen sharply for three straight sessions as both the value of the dollar and the yield on 10-year Treasuries retreated. But disappointing earnings last night from a trio of tech names may spoil the party this morning. Or at least give it some reason to pause. The poor numbers from tech land remind us to look forward, not back. The great opportunities that technology created over the last quarter century are now maturing. The good news is that new opportunities will appear. They always do in a capitalistic entrepreneurial society.

Stocks rose sharply for the third straight session. It’s earnings season. Through yesterday, the results were basically in line with lowered expectations, but perhaps the biggest driver of higher stock prices was the reversals over the past several days in the value of the dollar and the yield on 10-year Treasuries. Within a bear market …

October 12, 2022- As we enter earnings season, attention will shift from interest rate fears to corporate performance. Pepsi kicked it off this morning with good results, hopefully an encouraging sign. As always, the story for the season will revolve around expectations versus reality. In July, reality beat expectations sparking the best rally of the year. The key will be the relative performance of the large tech names, notable laggards coming into earning season.

Stocks ended mixed yesterday in a very volatile session where the Dow Industrial Average moved back and forth by more than 1000 points. News was rather sparse. A brief afternoon plunge occurred after the Bank of England signaled it would halt its planned intervention to support the pound Friday as originally planned. Stock, bond, and …

October 5, 2022 – Two huge up days in a row put bulls back in charge. Is this the market bottom? Only time will tell. It will largely depend on the severity of the pending economic downturn. But retreating interest rates, and weaking labor market statistics suggest the end to the Fed’s cycle of higher interest rates is nearing an end. That is at least one key ingredient to the end of a market downturn.

For those of you who have read my letters over the years, you should know about my 2-day rule. It states that two consecutive days of outsized moves in the opposite direction of recent market trends marks a reversal. Certainly, the gains Monday and yesterday qualify as strong up sessions in sharp contrast to the …

August 26, 2022 – Markets continued to consolidate the ~20% spike off June’s low with minor rebounds the past few days. In anticipation of Chairman Powell’s long-awaited speech at Jackson Hole today, stocks are priced for a somewhat hawkish update. Anything that deviates from that position could release energy in either direction. Other news items require some attention as well that could affect GDP going forward.

Stocks staged a late day rally to help bring all 11 S&P sectors to a positive close yesterday. Gains were led by Basic Materials, Technology, and Communication stocks. The risk-on tone had defensive sectors lag the overall market with Utilities, Consumer Staples and Health Care stocks fractionally higher. Rallies continue to follow the Treasury market. …

June 13, 2022 – Friday’s report on Consumer Prices told us all that the fight against inflation will be harder than previously anticipated. This week, the Fed will increase interest rates again. It may suggest the ultimate Fed Funds rate this cycle will need to be higher than previously thought. None of this is good news for equity investors.

Friday’s CPI report didn’t make investors happy. Led by sharply higher energy expenses, and the fastest growing shelter costs in decades, the message loud and clear was that inflation shows no signs yet of abating. Recognizing that government steps to curb inflation only began in March, the numbers we are seeing now weren’t impacted one …

May 25, 2022 – While the Dow tries to find its footing, the NASDAQ continues in steep decline as one former darling after another faces reality. It’s an ugly picture and it isn’t over for the speculative end of the market. for those looking for safer havens, more dependent on predictable cash flow growth, the picture is far better. The contrast between the two worlds was most evident yesterday.

Stocks fell once again although a sharp afternoon rally reduced the damage. Still, the NASDAQ fell another 2.4% after a prominent social media company lowered earnings guidance just a month after it previously offered a somber outlook. As a group, social media and related companies depend on advertising for revenue. With the economy slowing and …

May 2, 2022- When leadership gets taken out to the woodshed, the whole market dies. That is what happened last week. While some escaped (e.g., Microsoft) the loud and clear message is that the big boys of the S&P 500 are now at or near economic maturity. That isn’t a message a market already worried about interest rates and recession wanted to hear.

Stocks sank on Friday to close out one of the most miserable months for equities in many years. The NASDAQ took it on the chin the worst after Amazon# reported a weaker than expected outlook for its retail business when it reported results Thursday night. On Friday, Amazon# suffered its worst percentage loss since the …

March 25, 2022 – Investors continue to grapple with inflation, war news, Fed tightening and valuations. Historians will point to stocks not topping until earnings peak, inversion occurs and/or better alternatives. We got some answers over the past few weeks but cloudiness prevails, for now.

A few weeks ago, there were almost no positives to think of. Most investment advisors were bearish. Cash was sitting on the sidelines earning nothing. Short sellers were pressed. Russian invasion continued to look worse by the hour. Oil, wheat, natural gas and many other commodities spiked higher even after doubling since Covid. The most …

March 21, 2022- The Fed did what it said it would do, economic growth remains intact, and the war isn’t getting worse by leaps and bounds. That set the table for a strong rally in stocks. Is the bottom in? Or is this just a bounce? The answer may be a little yes and a little no. For some stocks, the bounce might be over, but if the economy stays solid, there remain plenty of opportunities.

Stocks rose sharply all week as the NASDAQ rebounded out of bear market territory and both the Dow and S&P 500 cut their 2022 losses roughly in half. Oil prices remained volatile closing at over $100 per barrel. Pain at the pump continues but it isn’t getting worse, at least for now. Interest rates rose …