Lockdowns in Austria sent the Dow and S&P 500 lower on Friday although the NASDAQ continued to rise. Interest rates remained within a tight range.

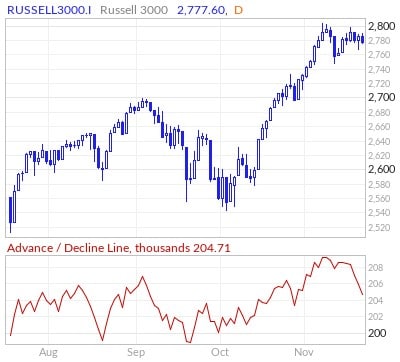

While stocks continue to rise, look at the chart below. It is a chart of the Russell 3000, perhaps the market’s broadest relevant index containing, as the name implies, 3,000 companies. Note that while stocks waver near all-time highs (the blue line on top), the number of shares rising (advances) versus the number of shares declining has been in rather steep decline for several days. What does this mean? It says that a handful of big cap stocks are keeping the leading averages near record levels. But that hides the fact that the overall market has been giving ground for the last few weeks.

What are the implications?

For one, there are increasing and broad concerns. Covid-19 case numbers are rising yet again, although I would note that the spikes this time are geographically different than they have been. Do you know any one local market that has been in crisis mode twice? It seems this disease finds its weak spots, mostly in geographies under-vaccinated and under infected. I am certainly not an epidemiologist, but a layman’s interpretation is that the disease is running its course. It isn’t giving up, though, until it runs out of weak spots. The good news is that hospitalizations, nationally, remain relatively low and life stays normal, at least in the US. Yet Austria’s experience shows that, worldwide, Covid-19 isn’t ready to disappear quite yet.

Austria isn’t a world economic power but related nations like Germany matter. Yet the overall direction relative to Covid-19 is that the worst is over even if isolated hot spots happen for an extended period. Investors and corporations can deal with that.

Indeed, there are increasing signs that recovery is continuing and that supply chain bottlenecks are being reduced. The only serious retardant to overall GDP growth next year will be a decline in federal government spending as crisis Covid-19 payments wind down. Most already have.

The markets have other concerns beyond Covid-19. A major one has been inflation. Yet long-term interest rates suggest markets are less concerned than the media or whoever responds to consumer surveys. Of course, we all know that inflation at the moment is close to 6%, but that won’t last. A lot of that is commodity centric. Commodity prices are volatile. When prices rise, supply increases as demand decreases. Balance gets restored. Don’t expect the prices for beef, gasoline, or homes to keep rising at their current pace for months or years to come. The real question is whether wage and rent inflation will persist. Can fading Covid fears entice millions back into the workforce? Or have life habits changed enough such that labor participation rates will never recover to pre-Covid levels?

Side by side with this discussion is the future course of monetary policy. To that end, President Biden’s choice of who will lead the Fed should be announced this week. Although there do not appear to be significant policy differences regarding interest rates between incumbent Jerome Powell and lead contender Lael Brainard, Mr. Biden has at least two other Fed Board seats to fill. Markets want the Fed to remain independent of political pressure. Should Mr. Biden nominate three or four who advocate for greater regulation and supervision, markets could react negatively.

Next, while the House has finally passed the Build Back Better bill, it got the votes needed by stuffing the bill with new agenda items that have no chance of staying once the Senate gets its hands on it. How much chopping and slashing will be required to finish the legislation is still in doubt. The Senate will ultimately pass something. Then it will be up to the House to either accept half a loaf or stand on principal and accept none. The consensus assumption is that the House will pass almost anything to get the bill over the finish line. Nothing is certain with this fractured Congress.

While all these concerns are important, maybe a glance at Friday’s list of new highs and lows is even more revealing. Big names like Apple#, Nvidia, Microsoft#, Home Depot#, Alphabet#, and Adobe all set new highs. In contrast, look at the new low list. It was filled with yesterday’s hot story stocks, names like Teledoc, Zillow, Robin Hood, Penn National Gaming and Draft Kings, all hot names that now must show that they have any kind of proven economic model that allows them to make sufficient money to justify even their current prices, often 50% or more below their peak over the last 52-weeks.

It isn’t just the growth imposters that are giving ground. Oil stocks have been market leaders all year as oil prices surged, but oil prices have started to fade as they normally do in the fall. Bank stocks were hot for a while as the 10-year Treasury started to rebound, but that has stopped. Even with good growth numbers, the 10-year yield remains well below spring highs. The rally in the travel and leisure stocks so savaged by Covid-19 seems to have faded as well. The stubborn persistence of Covid is one factor. Maybe a bigger factor is that the market caps of some of the leading cruise ship, airline and hotel stocks had surpassed levels reached in 2019 prior to the pandemic. Does it make sense for these names to go sharply higher from recent peaks? Finally, GDP growth peaked in the spring and is on a path to return to normal, meaning 2-4% by the middle or end of next year. The spending boom of the Federal government that lifted all boats as it handed out Covid relief money right and left has faded. No more $15 per hour to sit on the couch.

This shouldn’t be a surprise. Months ago, we noted that fading growth was inevitable. It should have been priced in. To some extent it has. After all, stocks are still near highs, but companies reliant on economic growth, or stocks that depend on euphoric investor mood swings, are fading a bit. So far, there are few signs that the market is on the precipice of a serious correction. Some of the hype seems to be fading. Fading, however, doesn’t mean disappearing. Record fine art sales in New York last week focused on hot new trends shattering previous price records while old stalwart names attracted buyers but few records. Sounds a lot like the stock market. Bitcoin, which surged through the summer and fall is now over 15% below its recent all-time highs. Mood swings still matter. I have no idea whether the next $10,000 move in bitcoin is up or down. Fundamentals don’t matter.

Normally, November and December are good months for stocks. With the economy still growing, there aren’t a lot of reasons to suspect this year will be different, but equities have come a long way from the Covid-19 nadir. Should inflation persist at some level higher than the pre-Covid average below 2%, it will provide a headwind. 2020 and 2021 have been rewarding years for investors, but growth rates are fading. Forward progress from here will be harder. Markets continue to reward the giant companies that can maintain growth well above average within a decelerating economy. Those winners are becoming fewer and fewer. Eventually, they too will be overpriced, and any modest correction cycle will become complete. The naysayers are out there talking up big corrections or a bear market, but that doesn’t seem likely. What does seem likely is a struggle between rising earnings and falling P/E ratios as the economy normalizes. That suggests a volatile sideways market for a while, not a huge price to pay for the surge experienced over the past two years.

Today, Scarlett Johansson is 37. Mark Ruffalo turns 54. Jaime Lee Curtis is 63. Finally, tennis legend Billie Jean King turns 78. Can you name the rock ‘n roll hit penned in her honor over 40 years ago?

James M. Meyer, CFA 610-260-2220