Market participants, in both stocks and bonds, waited with bated breath for the conclusion to the 2-day Federal Reserve Meeting. After two straight months of worrisome inflationary data, lower than expected employment reports and a continued rise in consumer spending, many were frightened at the prospect of the Federal Reserve changing their stance and pulling the proverbial punch bowl via tapering. On the other side of the coin, some were worried the Fed would ignore the rapid rise in inflation and solid growth and let inflation run too hot. There was no chance Chairman Powell could make everyone happy. This creates a whipsaw event, similar to previous important meetings.

The most notable nugget was a change in Dot Plots. Take this with a massive grain of salt, but officials are now expecting two rate hikes in 2023 which is pulled forward from 2024, which is two and a half years from now. Frankly, we haven’t seen the Fed be able to project six months into the future with any semblance of accuracy so this is a big nothing burger.

On a smaller note, they had a very faint switch with forward guidance being described as going from “extremely dovish and patient” to “moderately dovish and bullish.” I agree with the sentiment. They finally acknowledge the need to discuss a plan to taper in the future. In all likelihood it is still early 2022 before slowing down their $120B monthly bond purchases. Even then, it looks to be a gradual reduction. Powell is concerned about the last tapering period where Bernanke spoke too soon of slowing bond purchases which caused a massive spike in rates almost two years before they actually started to taper. Threading this needle, without disrupting a recovery in labor markets is mission #1.

With a stated goal of “average” inflation over 2%, there is plenty of room to run before it becomes an issue for this Fed. Twelve months from now, stimulus checks will be gone, reopening businesses will be back to normal, supply chains will be fixed and commodity prices will continue to normalize (lumber is down nearly 50% since May). Case in point on the inflation front stems from last month. If one excludes a one-time jump in airfare and auto prices, which won’t be repeated when the semi chip shortage allows more cars to be manufactured and more planes come to the tarmac, and if one backs out oil prices, then the overall inflation spike was only 2.3% last month, slightly above historic norms. If the month of May, which is the peak in inflation, and had a slew of reopenings, pent-up travel demand, stimulus spending and a flush consumer, can only produce fractionally higher inflation, what will happen next year when all of this is behind us?

Even if inflation stays elevated, the Fed has their second mandate to hide behind, which is full employment. Today, there are more job openings than people on unemployment. Labor shortages are real but concentrated in those industries most affected by the pandemic. Restaurants, retailers, leisure and hospitality businesses are having a tough time fully staffing the sudden demand increase. It will take time for lingering virus fears, child-care troubles, expanded Baby Boomer retirements and disincentives to work stemming from jobless benefits to subside. We won’t get back to full employment at least until year-end.

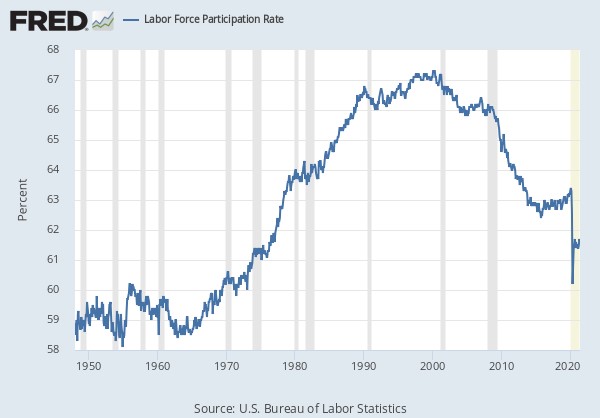

An unemployment rate below 4% is one thing. Even further, the Fed is clearly focused on the Labor Force Participation Rate. This is the percent of our population that is either working or looking for work. Once someone stops working and actively looking for work, they are excluded from the unemployment rate calculation, causing a drop in the number.

Here is where we are at today:

In short, there are millions more that need jobs to get us back to pre-covid total employed levels that are not included in the headline unemployment rate. An oft-cited Government statistic used is U6, which is a combination of those unemployed plus those taken off the “official” number who can come back to the work force. This metric points to a 10.2% unemployment rate. If the Fed continues to focus on the marginally displaced worker more than in previous years, it will allow them to keep rates lower for longer, assuming inflation proves transitory. Getting from ~62% of our population back to 66% in the workforce could take years.

This all brings us back the market reaction. Within minutes of the Fed’s statement, interest rates spiked higher across the board. Most dramatic was the 5-year Treasury jumping 5bps from 0.83% to 0.88%. We’re talking minimal numbers here but on a percentage basis these moves are historic. The 10-year Treasury increased by 8bps to 1.57%. While a large one-day move, this only puts the yield back to where it was 10 days ago. Fast forward a whole 24 hours to Thursday and the moves are quite different. The 30-year Treasury is actually down 8 bps from pre-Fed and the 10-year is right back where it started. Only the shorter end of the yield curve held the rise in rates leading to a flattening of the yield curve. Score one for the “inflation is transitory” camp and deflation is still a big problem long-term.

For equities, it was also a tale of two markets. Initially, financials and higher rate beneficiaries outperformed while utilities, consumer staples and growth technology took it on the chin. Yesterday, the Nasdaq jumped nearly 1% while the industrial heavy Dow Jones declined 0.6%. The Dow is having its worst week since January, albeit only a 2% decline so far. Lower long-term rates can still assist elevated P/E’s. However, companies who benefit from this need to show predictable, organic growth that is not driven by stimulus alone. Heavy cyclicals, basic material companies and banks are dependent upon inflation or higher interest rates that stemmed from excessive money printing. Any semblance of that slowing, and these get slammed. Many are down 10% – 30% in just a few weeks. It will be interesting to see how this plays out over the coming months as the Fed is still data dependent. Not to sound like a broken record, but this technology bull market is not done yet and the cyclical trade will be more selective in nature going forward.

James Vogt, 610-260-2214

A couple of singers share a birthday today as Blake Shelton and Paul McCartney turn 45 and 79, respectively.