Another quarter is in the books as we enter October which historically has been a favorable seasonal time to be invested. This is especially true in years where stock market returns are already generous. History says we should expect a solid finish for 2021. Even after a nearly 5% drop across the board in September, the S&P, Dow Jones Industrial Average and Nasdaq are still up 15%, 11% and 12% respectively this year. Although September carried on its long tradition of increased volatility, major averages are within 5% of all-time highs.

Indices closed at support levels yesterday as selling pressure increased into the close. Every S&P sector was down. One might call that indiscriminate selling; get out at any price. Holding here and consolidating during what is likely to be a choppy earnings season is critical. 4,300 on the S&P could be a line in the sand. Closing below that may bring in additional technical sellers. Chart reading has minimal real-world fundamental research applied to it, but market participants and black box trading firms pay strict attention to well-recognized support levels. Once a ball gets rolling downhill, it can accelerate. If this happens, opportunities will arise. It is always good practice to build a shopping list and identify entry points. Odds of this happening now are a coin flip, especially as headwinds mount up.

What could go wrong from here? Let me count the ways:

1. Last mile deliveries during the all-important holiday season have been a consistent issue as internet sales exploded over the past decade. This time around, it is the first mile that has problems. Shipping from partially closed factories to jam-packed ports and on to ships that are stuck in traffic will prove difficult this season. Companies that prepared for this in the summer will benefit. Others are looking at lost sales.

2. A slew of earnings reports will be out, starting in two weeks. If off-quarter reports from Nike#, FedEx#, CarMax# or Accenture# are any indication, it is going to be a rough period. They all reported decent, not great, earnings. Investors have become accustomed to sizable beats on revenue and EPS over the past few quarters. Outperforming analyst expectations at a record pace was never going to continue. We are already well above pre-pandemic levels in many ways, which surprised investors over the past few quarters. Now they expect more. Growth from here will not be a straight line. Look at how far we’re already above 2019 pre-pandemic levels.

3. A major factor contributing to less than stellar earnings reported in September stems from the obvious: freight delays, wage pressures, lack of talented employees and transportation costs. Demand is robust, but margin pressures and a lack of finished goods are not ideal situations with stocks up 15 – 20% already.

4. DC bickering over debt limits, 2 massive spending bills awaiting votes, possible tax increases and declining approval ratings for the current regime also brings pressure. Markets do well when things are calm and belief in the President is high. Consumer confidence has more power than one may think.

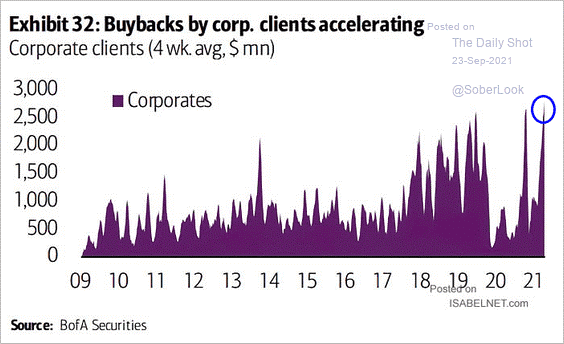

5. Massive cash flow is bringing share buybacks to record highs:

This is great overall, but during reporting season buybacks are paused. This removes a sizable buyer of stocks.

6. China will always be a wild card, but recent events there are still surprising. Their latest move is to order state-owned energy companies to secure oil supplies at all costs. The last thing we need is an energy crunch bringing comparisons back to the 1970’s inflationary cycle. Once this news broke yesterday, stocks went from green to red across the board.

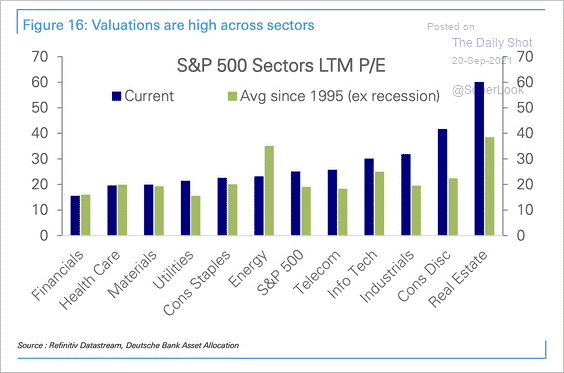

7. Valuations remain elevated, leaving no room for error (on earnings or interest rates):

8. Government stimulus is starting to decline as Central Banks in developed markets are expected to slow bond purchases. More concerning, emerging market central banks have been raising rates all year in order to combat inflation. A tightening cycle is upon us albeit in the infancy stage. This won’t matter much in the near term, but conditions will be less stimulative than the past 18 months.

We’re not ending this quarter on a sour note. 5% – 10% corrections happen, especially after major averages double in price just 18 months. Covid-induced supply chain disruptions will improve from here. Earnings expectations got ahead of themselves in the near-term, but today’s missed revenue opportunities become tomorrow’s prospects. Valuations, although stretched right now, will gradually decline as GDP continues to grow above trend. So long as interest rates remain range bound, markets can support higher than usual P/Es. By the end of October, debt ceiling woes should be resolved. Stimulus bills will hopefully get approved before year-end as well.

We welcome the 4th quarter and recognize that any further declines will probably be an opportunity.

Captain Marvel’s Brie Larson is 32 today while Julie Andrews turns 86. On the political side, former President Jimmy Carter is now 97 and Prime Minister Theresa May is 65.

James Vogt, 610-260-2214