April’s consumer inflation report was well received, with a continuation of a gradual slowing for inflation. Ditto for the Producer Price Index yesterday morning. Our infamous “Fed whisperer”, Nick Timiraos, helped fuel a minor rally in growth stocks when his latest Wall Street Journal missive noted “Federal Reserve officials were already leaning toward taking a summer vacation from interest rate increases to see if they have done enough to slow the economy and inflation. Wednesday’s inflation report makes that easier because it showed price pressures aren’t worsening and might soon be slowing as muted growth in rental-housing costs feed through to official inflation gauges.” Futures markets are now pricing in a 99.1% chance of a pause in June, a 0.9% chance of a cut and a 0.0% chance of another rate hike.

Granted, this could be too late, as Fed Funds, tighter lending standards, and deposit and credit issues rising at regional banks are already bringing down growth expectations. Yesterday, PacWest noted that during the misleading media timeframe of them looking to sell the company they lost 10% of their deposits. The stock dropped another 22% yesterday and brought down banks across the board. Interest rates continued their trek lower, pricing in a much slower macro environment down the road. If more banks fail, lending standards will get even tighter.

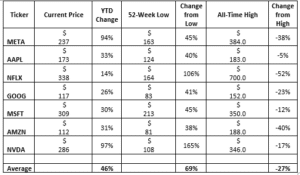

However, lower interest rates help fuel a growth stock rally. This occurs as cyclical/value stocks get sold. The Russell 1000 Value Index is down ~1% on the year, while the Russell 1000 Growth Index is up 16%. FANGMAN stocks (Facebook, Apple, Netflix, Google, Microsoft, Amazon, Nvidia) extended their advance with massive returns so far in 2023. Granted, most are still well off their highs from the Covid bump. Below are the stats. Even with a 46% rally this year, they are down 27% from recently seen all-time highs.

Needless to say, this is not constructive for investors with a valuation and diversification philosophy. The generals are on the field, but the soldiers have all left. This works itself out in either of 2 ways. Either leadership broadens out or mega caps have their own correction. Time will tell if the economy can hold together in the face of a brewing, Fed-created storm.

Transitions are Hard:

Looking ahead to the coming years, one thing is certain, and that is that our landscape will change. Technology, in particular, continues to rapidly change course. Last year, emphasis was on the Metaverse. Prior to that it was autonomous driving or 5G. Before that it was work-from-home and high-speed internet. Today, everything is centered upon Artificial Intelligence. The future looks amazing (scary) when one ponders how influential this can be. However, what are investors to do? Clearly, yesteryear’s winners will have to adjust or be disrupted. New billion-dollar unicorns are being created as you read this commentary. As we have seen throughout the years, a world-class company today could be a horrible stock to own over the coming decade. Much work needs to be done on all portfolio positions.

Case in point, let’s take a look at a well-known, world-class operator which is celebrating its 100th year since being founded by Walt Disney. For decades, Disney# churned out historic characters, movies and TV shows. It is difficult to find someone who does not know who Mickey Mouse is. The success of their franchises helped expand revenue sources from movie theatres and TV shows into theme parks, apparel, accessories, DVD’s, digital downloads and everything in between.

About 8 years ago, things started to change with their purchase of BAMTech. Bob Iger realized, maybe a bit too late, that the future of Disney was in trouble. Netflix had already destroyed Blockbuster. Chord cutting was in its infancy, but the future was clearly going to be different. This is not a bashing of Disney stock per se. Disney had a very lucrative flywheel and turning that siphon of high margin, high free cash flows off and risking everything by going into streaming would be impossible to do overnight. However, they had to pivot.

Disney+ was introduced in 2019, using BAMTech’s technology architecture. Shows and movies were pulled from other streaming platforms, which were paying quite a chunk of cash to Disney for the right to use them. Now that everyone could stream a massive library, sales of DVD’s and digital downloads collapsed. When my children were younger, I probably purchased a dozen DVD’s a year to make them happy (3 kids under 3 years of age at one point). At $20 a pop, it was quite the expense. Now, anyone can get the entire Disney historical library, and then some, for $8/month. The market changed and Disney had to follow suit.

What does that mean for investors? Well, Disney stock has gone nowhere since 2015, a full year before their BAMTech purchase which put the writing on the wall. That is not to say that Disney is a bad purchase today, just that any world-class operator could be heading for a tougher road going forward. If Mickey Mouse can last for 100 years, Disney can probably keep him relevant for the next 100. However, making profits, which is what stock investors desire, could be more difficult in a fast moving, technology driven, highly competitive marketplace. Those that stand still will be left in the dust.

How many of your stocks are involved with AI? How many recognize the fast-changing future and are leading us into it as opposed to holding onto old visions? Today is always a good time to prune losers and focus on next year’s future leaders.

Rami Malek is 42 today. Emilio Estevez turns 61. Jason Biggs is 45.

James Vogt, 610-260-2214