Are we in a new Bull market? Last week the S&P 500 rallied to its highest level this year which put the index 20% above its October lows. On a year-to-date basis the index is up 12% led by mega-cap technology stocks. However, as we mentioned many times before, not all stocks and sectors have participated in the market rally until lately. The Nasdaq which has many of the top mega-cap technology stocks but little exposure to many other sectors is up over 30% this year.

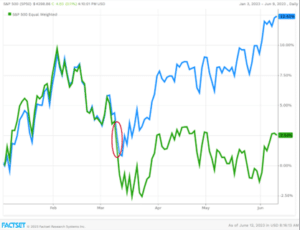

The year started off with the S&P 500, which is market cap weighted, and the equal weight S&P 500 rather tightly correlated up until March 9th, which marked the start of the banking crisis earlier this year. (Chart Below)

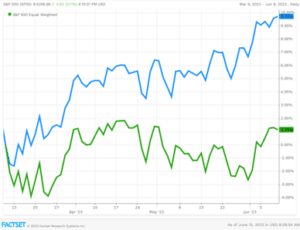

The last three months have seen a dramatically different story as the S&P 500 has outperformed the equal weight S&P 500 by over 800 basis points. (Chart Below)

There are two key reasons for this performance. First, the banking crisis hit the financial sector the hardest. JP Morgan# is the largest bank in the U.S. but is just the 12th largest holding in the S&P 500. The crisis bled over to most other sectors apart from mega-cap technology. The mega-cap technology stocks were looked at as safe havens during this time instead of the traditional sectors like consumer staples and healthcare. The second reason is the Artificial Intelligence (AI) boom that we have seen take off this year. Those mega-cap technology stocks were also major benefactors of AI investing, even creating a new Trillion-dollar market cap company in NVIDIA. AI has been the major tailwind of this current rally.

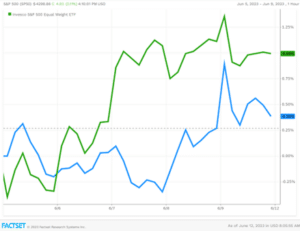

This past week is the first time since early March that the equal weight S&P 500 index has outperformed the traditional S&P 500. (Chart Below)

In addition, the Russell 2000 index, a small cap index also outperformed its larger counterpart this past week. The stock market rally broadening to include additional sectors and stocks is key for it to continue to move higher. A key industry for the rally to continue to broaden and move higher will be the banking sector which looks to have bottomed in early May and is beginning to see a recovery. The banks do not need to lead the market higher but they will need to participate.

While the NASDAQ and the S&P 500 are technically in bull market territory it would be nice to see other indices confirm this move. The rally does have some tailwinds at its back. First and foremost is the explosion in artificial intelligence. AI is in the early innings and it can continue to lead the market to new highs while taking other stocks along for the ride. Momentum can have major effects on the market both on the up and down side of things. Second, the broadening of the rally can force the averages higher as well. Third, corporations have done a good job at cutting costs and margins, and earnings season was not as bad as feared. Finally, the money printing which occurred during the pandemic has pushed off a recession at least for now. At this point the consumer is still working through excess savings from the pandemic. They have low leverage as most have borrowed prudently and at lower-than-normal interest rates. Also, at this point they are working within a tight labor market as businesses realize that labor shortages are a problem with boomers retiring and low immigration.

This is NOT an all-clear signal to pile into the market, and in the short term the market looks a little overbought. Do not chase the momentum stocks that have seen huge AI-induced rallies. Always remember that momentum goes both ways. Instead look for buying opportunities if some of the higher quality companies pull back at some point. Look for those high-quality names that may not have participated in this rally yet. Build your list of companies that you will want to own during a recession. While a recession has been delayed, most experts would agree that there is one still looming, and it could be sooner than some expect. The Fed has raised rates at one of the quickest paces ever and the effects of those raises have yet to fully be seen. The yield curve continues to be inverted by over 150 basis points between the 3 month and 10-year Treasury. The economy is slowing. While the market can continue to go higher for now there are plenty of warning signs out there so use caution and do not be afraid to book profits along the way.

Looking at the week ahead the major economic event will be the FOMC meeting on Wednesday. The market is expecting the Fed to pause but it still appears to be a close call. The Fed has guided to a pause this month but the market will get a major data point that could affect the decision on Tuesday morning with the CPI report. If inflation were to come in too hot, could that cause the Fed to surprise the markets and continue raising rates? It is doubtful but not completely off the table. At this point the market is expecting a rate hike in July but there will be another inflation report prior to that meeting. The market in general does not like surprises. For now, we chug along with the hope that the broadening rally we saw last week continues, but with a watchful eye to the possibility of a looming recession down the road.

Historical figures Anne Frank and President George W. Bush were born on this date, while supermodel Adriana Lima turns 42 and actor David Franco is 38.

Daniel Rodan

610-260-2217