Stocks staged a late day rally to help bring all 11 S&P sectors to a positive close yesterday. Gains were led by Basic Materials, Technology, and Communication stocks. The risk-on tone had defensive sectors lag the overall market with Utilities, Consumer Staples and Health Care stocks fractionally higher. Rallies continue to follow the Treasury market. In sync with a declining 10-year Treasury yield (from 3.11% to 3.03%), fund flows shifted to offense with semiconductor and software stocks extremely strong.

This brings us to the main event, Fed Chairman Powell’s speech at 10AM. We doubt he brings us anything surprising. However, there are quite a few other items to look at in conjunction with the latest Fed intrusion.

Jackson Hole:

The speech starts at 10AM. Hedge funds have pressed the sell button, with stocks sold short now at levels 3X normal. It is clear that everyone is expecting a bearish tone that erases the pivot posture inferred during the last Fed meeting.

It is also clear that the Fed will not be able to get inflation down towards a targeted 2% level unless they instill some damage to the labor markets. 5% wage growth is not going to bring inflation down, especially when unemployment rates are at all-time lows. Simply put, consumers are making too much money, on top of the Government handouts during Covid. The question becomes how much pain must happen before inflation gets back to normal?

Layoffs are a foregone conclusion…at some point. Since consumer consumption is 70% of GDP, it is critical to thread this needle. Some job losses, belt tightening and slowness in discretionary spending are acceptable. Completely destroying the working class is not. Stocks have priced in the softer landing landscape with an expectation of some job losses but no deep recession. The fear remains a major contention due to the historical track record of the Fed which focuses too much on backward looking data (CPI, unemployment rates). Inevitably, looking backwards too much prevents the train from speeding ahead.

We all know it takes ~9 months before rate hikes impact an economy. This Summer’s 75bps hikes will not really hit GDP until early next year. We have not seen a Fed-induced bear market since 2008. One may say we are overdue for it. Any hint that this Fed will let the dust settle before making another policy error would be welcome news.

M2 Money Supply:

A different way to look at GDP is a combination of money supply and money velocity. We have discussed M2 money supply which is usually in the 7% range. During Covid it went to 27% and brought forth this inflationary spiral. Today it is decelerating from 5% with an expectation to go negative during the Fed’s balance sheet reduction phase.

The velocity of money is a measure of how many times a dollar is spent during a defined period. For instance, I buy a bike and the bike store owner uses that cash to fix his air conditioner. The AC repair person takes that cash and goes out to dinner…and so on down the line until someone saves the cash and slows velocity. For 20 years this velocity kept slowing and we are now at the lowest point since 1959. Money is not being spent as often as before, which is part of why the long-term GDP trend is down sloping.

Taking the above into account, there is a decline in money supply and the number of times it is spent, and together that equates to lower GDP. It will be very difficult for 2023 to show growth if money is tight, especially if it goes negative. The Fed cannot press the needle too much or GDP will be a major issue.

Stock Buybacks:

Jim Meyer touched on the new 1% excise tax that goes into effect next year for stock buybacks that exceed employee stock options. In effect, companies are penalized for lowering their share count. Salesforce reported earnings late Wednesday night and voila, they now have instituted their first massive stock buyback program to the tune of $10B. Dollars to donuts that they execute this before January.

These are not trivial numbers. Back of the envelope calculations show mega-cap conglomerates like Charter Communications and eBay would have taken a 3% hit to net income, annually, if this had been in effect the past few years. For Apple, that tax adds up to $1B every year in extra taxes and lower profits to shareholders.

Student Loan Relief Debt Relief Plan:

After passing the Inflation Reduction Act, the Administration came back and announced a $330B debt cancellation program to help relieve voters with outstanding student loans of a significant burden. The Government is forgiving up to $10,000 in federal student loans for those making less than $125,000 annually for individuals or $250,000 for married couples. Private loan holders are not included in the plan. Payments have not been required since the pandemic started but will now resume in January. Many lawmakers urged for $50,000 in relief.

On the surface, this is an admirable endeavor. Roughly two-thirds of all student debt in the U.S. is held by women. Also, African American college graduates owe an average of $25,000 more in student loan debt than White college graduates. Anything that helps level the playing field should be considered.

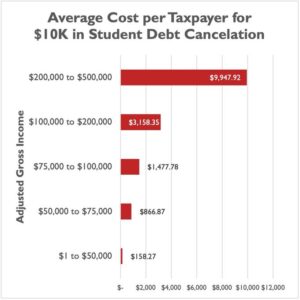

Since these are Government loans there are 3 ways to cover the losses: decrease Government spending (laughable), increase taxes (comes to $2,100 per taxpayer) or increase borrowing. On the surface, one would think the high-end taxpayer would take the burden:

@andrew_lautz

With no real plan to increase taxes attached to this “Act,” door number 3 is likely, tacking on more debt to the country’s balance sheet. Combined, the increase in debt erases the Deficit Reduction Act’s tally over the coming decade. So much for lowering inflation during a critical time.

In closing, a debt relief plan is estimated to add 0.2% – 0.3% towards consumer inflation, or $150 – $200 in higher costs per household. Not a huge amount, but it will impact those who are already tightening their purses. This is equivalent to adding 50bps on Fed Funds in order to stop that inflation. Throw in a backward-looking Fed, slowing money supply, and lower velocity, and 2023 is shaping up to be a very difficult year for GDP. While stock buybacks implemented today are likely to increase, that is pulling forward from next year as well. Relief rallies are still possible, especially if Chairman Powell is anywhere near dovish today, but we are hard pressed to get aggressive in a market where earnings per share still must come down and consumers have yet to feel the pinch of a tighter Federal Reserve. High-quality companies with clean balance sheets, predictable earnings, who are taking market share and have fair valuations, remain the place to be. There is money to be made, it just will not be as easy as the past decade.

Is it Christmas? My daughter’s favorite movie in December is Home Alone, starring Macaulay Culkin who is now 42 years old. Hard to believe, but Chris Pine is the same age. Melissa McCarthy turns 52. James Harden, Philadelphia 76ers forward and hopeful future NBA Champion, turns 33 today. Lastly, TOMS shoes founder, Blake Mycoskie is 46.

James Vogt, 610-260-2214