Financial Planning

Individuals

We provide financial planning services as a part of every new client relationship. Tower Bridge Advisors utilizes eMoney, a sophisticated planning tool that allows us to create a plan for clients in any stage of their financial life. Our planning tool enables us to input portfolio holdings, income and expense projections, and create easy to read charts and graphs to create a visual picture of your financial health. It also enables us to do “what if” scenarios regarding your future plans that enable you to see the impact of changes in the market, changes in income, changes in your spending plans or other changes that might impact your finances.

Institutions

Our institutional clients also benefit from using the eMoney planning tool. We can model the portfolio and then look at planned spending and assumed proceeds from fundraising or donations. We can then perform “what if” scenarios to determine whether spending levels can be supported without invading the corpus. This is critical when unexpected expenditures arise, or fundraising proceeds don’t keep up with the needs of the organization. Our goal is to ensure that your organization can continue to support its mission by having a sound plan for the future.

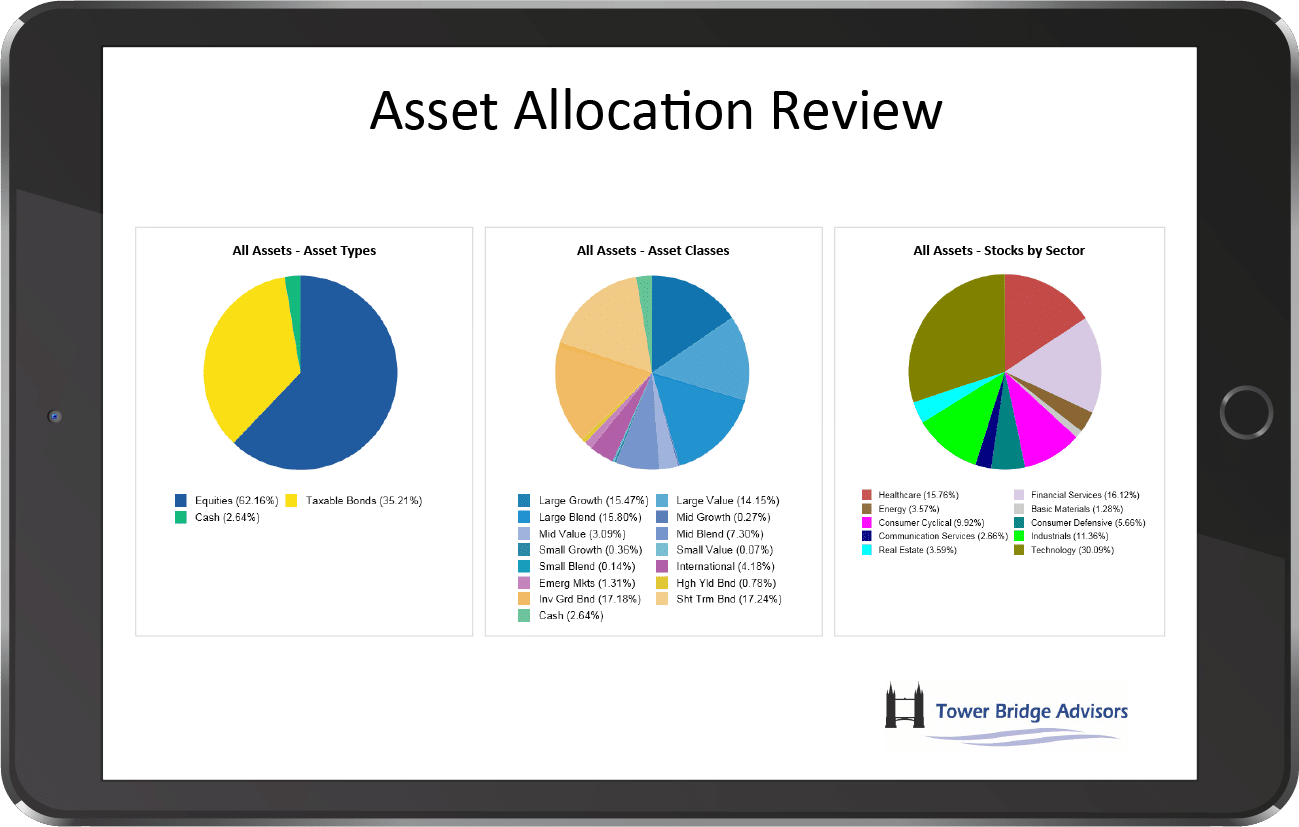

Entering client portfolio information into the system enables us to determine their overall allocation by asset type and by industry sector, to assess appropriateness of current allocations.

Mouse-over the image for enlarged view

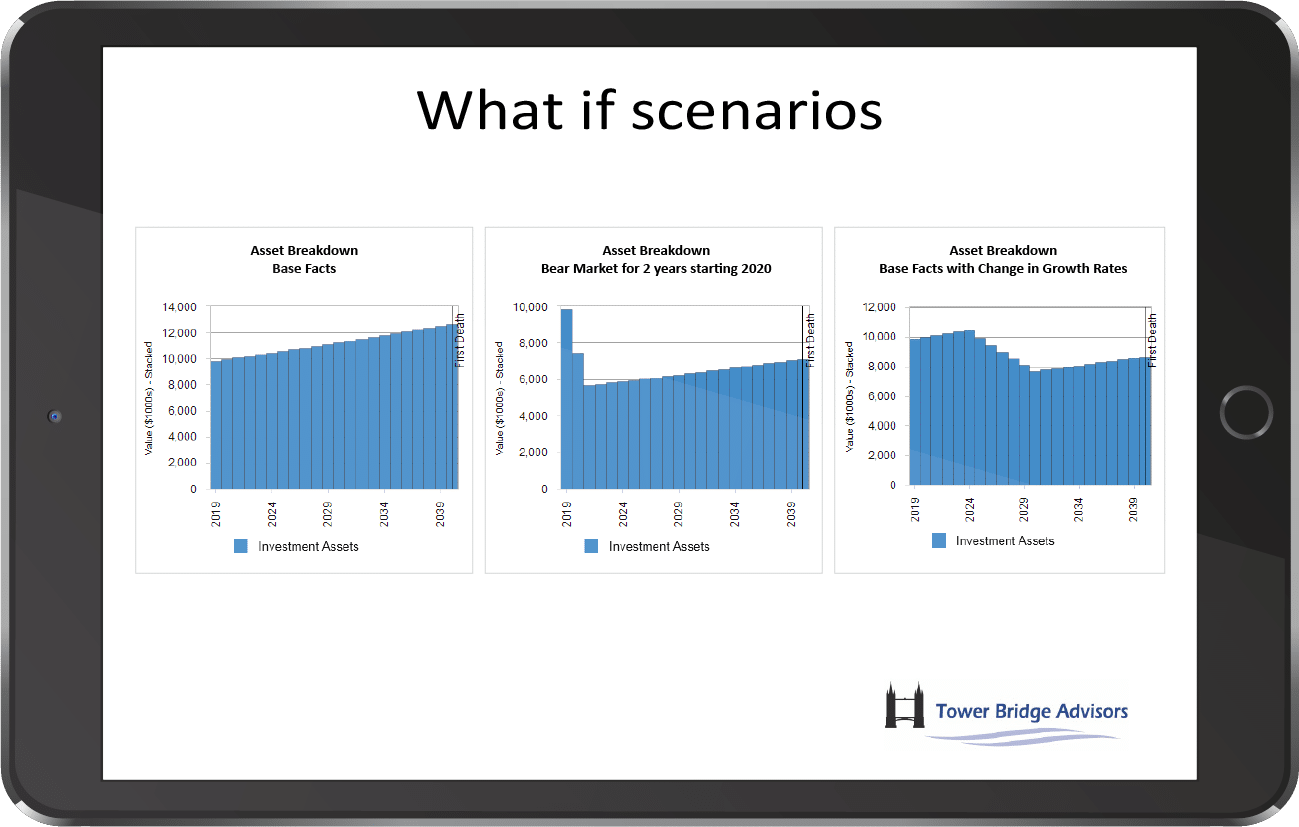

We can then create forward-looking scenarios that analyze a “base case” of current income and spending patterns, then perform “what if” analyses showing the impact of changing market conditions in the future.

Mouse-over the image for enlarged view