Stocks and bonds both took a breather yesterday in a relatively quiet session. During earnings season, we are likely to see up and down days depending on the daily reaction to individual earnings reports. Friday and Monday, trading was impacted by negative reactions to generally good bank earnings. Yesterday, United Healthcare# dispelled the worst fears …

April 15, 2024 – While the fears of military escalation in the Middle East may have been lessened by the ability of Israel to thwart the Iranian drone and missile strikes, risks remain elevated and markets remain nervous. While futures are modestly higher this morning, the euphoria of late March is gone and unlikely to return real soon.

Stocks slumped again on Friday ending their worst week in over a year. The decline was one part investor skittishness, one part the lack of corporate stock buybacks, one part fear of an Iranian attack on Israel over the weekend, and one part a poor reaction to Friday’s earnings reports by major banks. Futures are …

April 12, 2024 – Growth stocks rebounded yesterday from Wednesday’s sharp loss but the Dow finished about where it started.

Interest rates wavered throughout yesterday’s session but showed little change by the end of the day. This morning started earnings season as JPMorgan Chase# and Wells Fargo# reported. Results beat expectations but the early reaction in pre-market trading was to take some profits. We will see soon whether that reaction is a harbinger of things …

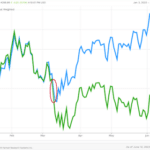

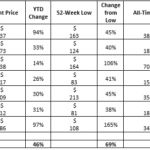

April 10, 2024 – As we enter earnings season, it will be time for investors to separate the wheat from the chaff. Macro winds matter, but in a growing economy with moderating inflation, the fortunes of most companies are driven by internal more than external factors. As investors, we see this in the wide dispersion of stock performance so far this year. We will learn more about winners and losers as earnings season unfolds.

Stocks finished mixed yesterday clawing their way back from a weak open as interest rates fell in front of today’s CPI report. That report is likely to be market moving. If March inflation cooled, stocks and bonds will both rally. If March inflation continued to run a bit hot as it did in January and …

April 8, 2024 – Over the span of three months, the economy has gotten stronger while inflation appears to have moderated much more slowly. For equities, those forces conflict. As of now, it appears the tailwind of strong growth has prevailed even as interest rates have gone up. But markets won’t ignore higher rates for much longer if there aren’t signs that the battle against inflation is being won. 2.5-3.0% inflation isn’t a substitute for the Fed’s 2% target. Right now, the Fed says it is on course to lower rates this year. But it is also data dependent. Wednesday’s CPI reading will give important clues.

Stocks rebounded Friday, erasing much of Thursday’s loss after the Labor Department issued a very strong employment report for March. Bond yields rose. At the start of the year, the prevailing narrative was that growth in 2024 would slow from the 3%+ rate of the second half of 2023 while inflation would continue to moderate. …

April 5, 2024 – Yesterday’s sharp afternoon decline probably supports the idea that the first real correction since last October is now in place. Today’s employment report and next week’s CPI report could either reverse that or accentuate the downturn. But sober reality suggests nothing we hear over the next week is going to change the basic conclusion that the economy continues to grow and the pace of inflation continues to moderate. Hopefully, a correction can correct some of the speculative euphoria that has been creeping in. That would be a good thing.

After a strong start following three sessions of losses, the Dow reversed course in early afternoon and fell sharply. All major averages fell at least 1.2%. It was the worst day for the Dow in a bit over a year. If there was a triggering event, it was a comment by a Fed President that …

April 3, 2024 – Was the correction of the past two sessions a serious warning or just a head fake? We probably need at least one more lousy day to make a serious conclusion. Clearly, the market has been overbought. Rising bond yields trigger apprehension. But the underlying fundamentals of an improving economy and moderating inflation suggest nothing more in front of us than a healthy correction.

After a sterling first quarter, stocks went into retreat during the first two sessions of the second quarter. After 5 straight up months without a correction exceeding 3%, some profit taking was due. Strong economic data led to a rise in the yield of 10-year Treasuries to the top end of their range. The yield …

April 1, 2024 – Stocks finished out a marvelous first quarter with a strong performance. This week we will get a bunch of economic data about March. It should show continued economic gains. Right now, the market doesn’t really care whether the Fed starts to cut rates in June or waits until next year. As long as growth continues and inflation slowly ebbs, investors are inclined to stay optimistic.

Stocks closed out the first quarter with another strong performance. The S&P 500 gained over 10% in the three-month period while the NASDAQ rose 9% and the Dow Industrials a bit over 5%. Stocks expressed broad optimism that inflation will continue to moderate and economic growth will be sustained without a recession. While a recession …

March 27, 2024 – At the fringes of the market speculative fever is migrating beyond euphoria to irrational. While it is somewhat isolated, the rest of the market isn’t immune. Whether yesterday’s volatile session is a warning sign or not won’t be known for at least a few weeks. But the mixture of such behavior with rational investing usually has a bad ending.

Stocks started off strong yesterday but a sharp selloff in the last half hour sent all major averages into the red for the session. The highlights, if that’s the right word, were the volatile movements in Trump Media & Technology Group, the parent of the Truth Social network, and the surge in Reddit, another social …

March 25, 2024 – Profit taking Friday did not stop last week from being one of the best for stocks this year. Markets still see clear sailing and an economic soft landing. They are content to live with elevated interest rates and an inverted yield curve, at least for now. First quarter earnings reports are just weeks away. Corporate stock buybacks will soon be suspended probably reducing forward momentum into earnings season.

Stocks gave ground Friday amid profit taking. A few earnings reports from key retailers unnerved markets. Bond yields stayed within a tight range. Lululemon and Nike both disappointed. It isn’t that either isn’t growing; it’s that both are growing more slowly than investors had hoped for. Success invites competition. Some of the competitors have become …

March 22, 2024 – Markets continue to soar as the Fed kept the path toward future rate cuts steady. The lack of surprise encouraged equity investors while bond investors yawned. With stock buybacks coming to a seasonal end over the next week, look for the market’s tailwind to moderate until earnings season begins.

Stocks continued to surge after Wednesday’s FOMC meeting left interest rates unchanged, while suggesting the first of three 2024 rate cuts might start in June. While stocks jumped, bond yields have shown hardly any change since the Wednesday meeting. So why the surge in stock prices? Obviously, I was fooled. On Wednesday I outlined a …

March 20, 2024 – Stocks rose yesterday as leadership continues to move from the Magnificent 7 to early cycle equities such as large banks, finance companies, big retailers, home builders, and insurance brokers. Today’s FOMC meeting will garner a lot of attention but don’t expect any rate cuts or statements to suggest a material change in direction is likely any time soon.

Stocks rose yesterday led by the Dow Industrials. That has been a theme in recent days as valuation, and in some cases, questionable fundamentals, get in the way of some of the high-flying tech stocks. Bond yields dipped slightly in front of today’s FOMC meeting. As of today, year-to-date, the S&P 500 is now outperforming …

March 18, 2024 – Consensus now agrees that our economy is slowing. Inflation is slowing as well but not as fast as hoped. The key question is whether a recession has been averted or deferred. There is evidence to support both conclusions. There won’t be a definitive conclusion at this week’s FOMC meeting. The next big focus will be on first quarter earnings when reports start coming a month from now.

Stocks fell Friday following a weak earnings report from Adobe#. Actually, results were in line with estimates and company management reiterated guidance. But when a stock sells for 30+ times earnings and doesn’t give investors an upside surprise, you get the reaction that Adobe got on Friday, namely a drop of 14%. Another headwind was …

March 15, 2024 – Inflation is persistent. That’s the message from this week’s CPI and PPI data. As more data exposes that fact, stocks face more headwinds. Momentum remains in favor and likely won’t turn around overnight. Bottoms are V-shaped while markets seem to roll over more slowly at the top. The ingredients for a serious bear market are not in place, but the rise in speculative fever increases the odds of at least a modest correction that could present better buying opportunities. Oh, did we forget to note that today is the Ides of March?

Stocks retreated yesterday after a second unfavorable inflation report within a week. This time the villain was the February report on producer prices. The yield on 10-year Treasuries has risen by 20 basis points this week, a definite weight on equity valuations. The odds of a first Fed Funds rate cut is now virtually nil …

March 13, 2024 – A hotter than expected CPI report didn’t disturb the market. The net result was a resurgence in demand for those stocks that have been leaders over the past several months. While there has been an expansion in market breadth, leadership remains within the tech sector. Without a fundamental catalyst that could cause rotation, momentum remains the dominant force today.

Despite a CPI report for February that showed inflation a bit more persistent than expected, stocks continued to rise yesterday even as bond prices fell. It was another record day for the S&P 500. The message of the market yesterday was that even though the persistence of inflation almost ensures no interest rate cuts in …

March 11, 2024 – A turnaround in the market Friday afternoon may be a harbinger that speculative fever may be about to cool. But Bitcoin and Nvidia# stock prices are up again in the pre-market suggesting speculation is far from dead. Tomorrow’s CPI report will be instrumental in determining the market’s near-term direction.

A favorable employment report, not too hot and not too cold, sent stocks higher Friday morning. But profit taking in the afternoon sent stocks lower for the session and the week. One day reversals in a bull market have little meaning without follow through. Although futures this morning point to a softer open, the poster …

March 8, 2024 – Powell stayed on point in front of Congress, and Biden used last night’s State of the Union address to start his Presidential campaign. With no new economic message, attention moves to today’s employment report. It will take an outlier number to be market moving. Valuation concerns aside, the path of least resistance is still upward.

Stocks surged ahead again yesterday. Three days of strength wiped out the damage done by Monday’s sharp drop. One day reversals have little meaning without follow through. While investors had reasons to be scared by the rapid rise in speculation, it wasn’t sufficient to derail the current rally. This week Fed Chair Jerome Powell spent …

March 6, 2024 – Summary: Speculative fever is rising. Yesterday’s market shows some awareness of this. Whether the balloon is being pricked or not will be determined by market action over the next several days. Usually, the first decline is just a warning sign. We’ll see.

Stocks fell sharply yesterday amid profit taking. For most of the past year, daily comments on the stock market have discussed in some fashion the leadership of the Magnificent 7. While Nvidia# continued to climb yesterday in a very rocky session, and Meta Platforms# stock is still up by a third so far this year, …

March 4, 2024 – Momentum continues to favor stocks as investors put cash to work in the market. This week, a flurry of data should support the notion that growth continues through Q1. The next big focus will be next Tuesday’s CPI report. Until then, I would expect relative calm in the absence of major economic or corporate news.

The rally goes on as all the leading averages moved to new highs last week. For the NASDAQ, it has been three years since its prior high during the speculative SPAC and IPO fever of 2021. Bond yields held steady. Looking for news this week, the focus will be on economic data from February, usually …

March 1, 2024 – February marked four straight up months for stocks. Speculative fever is rising as the fear of missing out increases. Some caution is warranted. Perhaps the next big news item will be the February CPI report due out March 12. January’s was ugly but markets sloughed it off. If February numbers are bad, ignoring the news may be a bit harder.

With February now over, and it took an extra day this year, equities have now risen for four consecutive months. Year-to-date both the S&P50 and the NASDAQ Composite are up 7%. Interestingly, four of the so-call Magnificent Seven are up anywhere from 10% to 60% while three are actually down. Interest rates are higher, normally …

February 28, 2024 – The economic backdrop continues to be solid. But that doesn’t mean all corporations have a free ride. They still must execute to succeed. Consumers have choices. If a business doesn’t provide the best value, business will flow to those that provide better alternatives. Yesterday, we saw news from two companies that leave us scratching our heads. Read on.

Stocks were mixed yesterday amid a dearth of significant news. Bonds mostly traded sideways. As noted, Monday, with most of the big earnings reports now out of the way, we face several weeks with little corporate information to feed on. There will be plentiful economic information that could be market moving. When we get into …

February 26, 2024 – The AI hype should start to recede now that Nvidia’s earnings have been digested. The focus should once again return to interest rates, inflation expectations and Fed policy with a PCE report due this week. With Q1 earnings season weeks away, changes in rates will become more impactful over the short-term.

The celebration over the Nvidia earnings report started to run out of steam Friday. The news was great and the celebration well deserved. But now it’s on to the next set of factors likely to move stock and bond prices. For now, the composite expectations related to the growth of artificial intelligence use have been …

February 23, 2024 – Markets loved Nvidia’s earnings. The upward adjustment to all AI-related stocks came quickly. The AI boom is likely to be long lasting but 300% year-over-year revenue growth won’t continue for very long. Beyond AI, the focus should be on bond yields and inflation. Next week’s PCE report will come into sharp focus either confirming fears set off by the CPI report last week or squashing them.

Stocks soared yesterday on the heels of a strong earnings report from Nvidia#. Over the previous several sessions apprehensive traders sold Nvidia stock and options expecting the company to tone down its future guidance when it reported. But that didn’t happen. AI is going to be for real, and companies that expect to provide AI …

February 21, 2024 – Nvidia reports tonight. Investor reaction is likely to set the tone for stocks in the days and weeks ahead. Was the recent sharp rise in the price of Nvidia and related companies too much, too fast? Or will strong fundamentals lift them further? Overnight, shares of Palo Alto Networks, a leading cyber security company fell sharply after management lowered future expectations. That will only raise the apprehension going into tonight’s report. Volatility is starting to rise. Tonight’s report will be key, not just to Nvidia, but to the entire market.

Stocks fell yesterday led by the high-flying tech stocks in advance of tonight’s earnings report from Nvidia#. We have talked ad nauseam about the impact of the Magnificent 6 or 7 (depending on whether Tesla is still in the elite list) on the overall market. Last year, these stocks accounted for more than half the …

February 16, 2024 – Markets have chosen to slough off Tuesday’s CPI report and yesterday’s announced retail sales decline as one-offs. Are they correct? More data will be needed but both should serve as warning signs that the idyllic conclusion that a soft landing and 2% inflation are not necessarily inevitable. At best, the data this week pushes off the first rate cut by at least a month. One month won’t matter in the long run presuming the underlying assumptions prove accurate.

As I noted Wednesday, for Tuesday’s decline to have been meaningful, there had to be follow through Wednesday and beyond. There wasn’t. Over the course of two sessions, stocks recovered the biggest one-day loss since last March. At least in traders’ minds, the disturbing CPI report Tuesday was an outlier data point. Inflation is coming …

February 14, 2024 – Did the Goldilocks scenario die yesterday after the January CPI report showed higher than expected inflation? One data point isn’t conclusive but clearly getting inflation to 2% isn’t going to be as easy as the bulls thought. Markets reacted in obvious fashion. Was the adjustment complete yesterday? Possibly, but today’s market action will be as important in determining near term direction as yesterday’s. Any negative follow through will suggest taking a more defensive posture.

The Goldilocks scenario may not be dead but it developed a mean case of Covid yesterday when the government issued the January CPI report. Goldilocks had said inflation was dying, deflating. But yesterday’s release threw a big bucket of water on that conclusion. At first glance it might not have looked so bad. The month-over-month …

February 12, 2024 – Stocks have now risen for 14 of the last 15 weeks. Most of the improvement has once again been concentrated in the 6 largest tech names. But the rest of the market has moved modestly higher as well. The lift from interest rates has ended but the surprising economic strength has been a big help. Some consolidation is logical although the catalyst for any correction at the moment isn’t obvious.

Stocks continued their upward trek. They have now risen for 14 of the last 15 weeks with the S&P 500 crossing the 5000 mark for the first time on Friday. It’s been quite a run with the S&P 500 rising close to 15% over that span. It all started with two related events. The Federal …

February 9, 2024 – GARP stands for growth at a reasonable price. Sometimes prices seem unreasonable because earning estimates are too low. Sometimes what seems reasonable is wrong because earnings estimates are too high. If one had to get one investing question right, it would be to judge whether current estimates are too high or too low.

Stocks were mixed yesterday in a listless session with very little economic or corporate news to move stocks or bonds in either direction. Earnings season is winding down with only the major retailers and a few key tech companies still to report. This morning, I want to talk about GARP investing. GARP stands for Growth …

February 7, 2024 – A quiet session saw few changes in either equity or bond prices. As earnings season winds down, we enter a period mid-quarter where minor new items can have outsized importance. The big companies have mostly reported and markets have reacted. Barring major changes in long-term Treasury yields, expect a quieter market in the weeks ahead.

Stocks edged higher amid little new economic or corporate news. Bond yields edged lower. Wall Street, at least for now, seems to be concluding that the first-rate cut will happen after March. Overall, momentum remains in favor of the bulls. More investors are trying not to be left behind amid a backdrop of lessening recession …

February 5, 2024 – We learned two things last week. First, the economy remains robust punctuated by Friday’s big employment report. Second, the Magnificent 6 are still achieving tremendous growth while the rest of Corporate America lags.

Stocks rose again Friday after a robust January employment report. After accounting for prior month revisions, the U.S. created more than 400,000 net new jobs. However, with the strong jobs report came higher interest rates. More employed workers suggests more capital needed to fund the expanded growth. On “60 Minutes” last night, Fed Chair Jerome …

February 2, 2024 – This week has been all about the earnings of the Magnificent 6 (dropping Tesla until we see a new growth engine). The five who reported, overall, exceeded robust expectations. Productivity in the U.S. grew 3% last quarter, at least in part due to the efficiencies these five companies and a handful of others bring to our overall economy. There may be a lot of bad stuff happening in the U.S. and around the world today, but there is little doubt that the engine for worldwide growth is the technological innovation that has been taking place for decades right here at home.

Stocks rose yesterday closing at session highs. The gains largely reversed the drop late Wednesday after Federal Reserve Chairman Jerome Powell threw a bucket of cold water on the idea that a Fed Funds rate cut was likely in March. I’ll offer two thoughts to that statement. First, how much economic importance should one attach …

January 31, 2024 – Markets have absorbed earnings reports from giants Microsoft and Alphabet without too much damage, only giving back gains of the past week or so. Treasury’s funding schedule for the first quarter was well received. Attention now turns to today’s FOMC meeting conclusion. All will be looking for hints as to when the Fed will begin to cut rates. There is a slight current bias toward delaying the first cut until May. But the Fed makes that decision, not the market. Any change in tone will be reflected in markets later today and tomorrow

Today marks the end of January. So far, the Dow is up about 2% for the month while both the S&P 500 and the NASDAQ Composite are up over 3%. All are likely to take a breather this morning after modest negative reactions to earnings reports last night from Microsoft# and Alphabet#. I say modest …

January 29, 2024 – This is the biggest week of earnings season. In addition, the FOMC meets, Treasury issues its forward funding schedule, and we receive a slew of economic data telling us how much momentum carried through to January. The net results will set the tone for markets over the coming weeks.

This is going to be a big week for investors. Over 100 S&P 500 companies will report earnings, including 5 of the Magnificent 7. There is an FOMC meeting that concludes Wednesday that could alter expectations of the pace of future rate cuts. In addition, the Treasury Department will present its forward funding schedule. Finally, …

January 26, 2024 – As earnings season shifts into high gear, we are seeing both some speed bumps and some pot holes emerge. Speed bumps happen when expectations need to be moderated slightly. Potholes surface when the hype surrounding future prospects are blown apart. This week both Intel and Tesla hit potholes. Investors in both need to reset hype to a new reality. Time will tell whether that process is over or just beginning.

Stocks rose yesterday as earnings season moved into high gear. The key aspect of yesterday’s market was the extreme volatility of the shares of recent tech leaders, perhaps a sign that a temporary pause is likely after some stunning gains over the past couple of weeks. Most of the companies that have been leaders of …

January 24, 2024 – In a flattish economy, the real winners are those that can create their own opportunities. Size helps. Companies with huge free cash flows can invest to expand moats that give them competitive advantages. Those advantages translate into higher margins. While the technology sector is fertile hunting ground, companies with superior competitive advantages exist across multiple economic sectors

Stocks hit another all-time high against a backdrop of generally favorable earnings. Bonds were basically flat. It’s still early in earnings season but some winners are surfacing. Notably, most of the Magnificent 7 continue to perform magnificently. No final conclusions until these companies report earnings, but we got a sneak peek last night when Netflix …

January 22, 2024 – While economic issues like earnings and interest rates dominate headlines on Wall Street, sometimes other factors surface that influence stock prices. Presidential politics and the impact of bitter cold weather both surfaced this past week. We discuss them below.

Stocks shot to record highs on Friday as consumer confidence shot up and early earnings season reports reinforced the notion that the U.S. economy is on solid footing. Over the past week, two other important headline news items emerged. First, Ron DeSantis dropped out of the Republican Presidential race leaving only Nikki Haley as a …

January 19, 2024 – As the markets focus on the end of the Fed’s tightening cycle, attention should turn to those industries that might benefit from lower rates. None stick out more than housing. What may surprise some is that the homebuilders in 2023 performed almost as well as the Magnificent 7. Today, we explore why and delve into the future for housing, an important sector within our economy, one that should support growth as mortgage rates start to decline.

As earnings season unfolds, the tone is mixed but in the positive direction. The leading averages responded yesterday with gains despite upward pressure on bond yields, a sign that markets believe a soft landing is increasingly likely. Today, I am going to focus on just one sector of the economy, housing. Just for background, I …

December 8, 2023 – Markets rallied yesterday but remained in tepid anticipation of today’s employment report and next week’s CPI report. The November employment report came in close to expectations with gains of 199,000. Not sure from the early read how much those numbers were enhanced by the end of the auto and Hollywood strikes. Markets reacted negatively to the report as month-over-month wages increased slightly more than anticipated. The unemployment rate fell to 3.7% as the labor participation rate rose to a pre-pandemic high.

Stocks rallied yesterday while bonds stayed mostly level in front of next week’s Federal Reserve meeting. For a change, the leaders were the big tech stocks, noticeable laggards over the last four weeks during a period where investors moved toward equities perceived as being cheaper than the high multiple Magnificent Seven. The pop in the …

September 18, 2023 – Markets are directionless, torn between better economic activity and an increase in storm clouds from labor unrest to China. What is crucial is the future trend for interest rates. Investors will parse this week’s FOMC meeting for clues, but probably won’t get a much clearer picture for their efforts.

Stocks have been trading sideways in a directionless pattern for the past month. On the plus side, earnings have exceeded forecasts and the economy continues to grow at a rate faster than economists had predicted. But that has been countered by a series of concerns: 1. Interest rates, particularly at the long end of the …

June 12, 2023- : The S&P 500 traded into Bull market territory last week on the back of a broad market rally. The broadening of the rally is key to continued optimism in the market. However, the possibility of a recession still looms, despite the rally.

Are we in a new Bull market? Last week the S&P 500 rallied to its highest level this year which put the index 20% above its October lows. On a year-to-date basis the index is up 12% led by mega-cap technology stocks. However, as we mentioned many times before, not all stocks and sectors have …

May 12, 2023 – While mega caps keep gaining steam, the average stock is now down for the year. Eight of the last nine trading sessions have been negative for the Dow Jones Industrial Average. The Fed may be done raising rates, but an all-clear signal is far off in the distance. Transitions are hard!

April’s consumer inflation report was well received, with a continuation of a gradual slowing for inflation. Ditto for the Producer Price Index yesterday morning. Our infamous “Fed whisperer”, Nick Timiraos, helped fuel a minor rally in growth stocks when his latest Wall Street Journal missive noted “Federal Reserve officials were already leaning toward taking a …

April 26, 2023 – Markets are being buffeted by crosscurrents. The banking crisis has come back into focus amid turmoil at First Republic. Earnings reports move individual stocks both ways. Bond market strength portends a weakening economy and slower inflation. Yet pockets of economic strength endure, mostly in the travel and leisure sectors. The net for equity investors is a standoff, one likely to endure for some time amid persistent rotation of leadership.

It was a wild day yesterday with several strong moves relative to earnings, a wild ride for First Republic Bank, the regional bank most people see as the stress point within the banking system, and a sharp rally in bonds. The major averages were all lower. After the close, solid earnings from Microsoft# reduced some …

October 26, 2022- Stocks have now risen sharply for three straight sessions as both the value of the dollar and the yield on 10-year Treasuries retreated. But disappointing earnings last night from a trio of tech names may spoil the party this morning. Or at least give it some reason to pause. The poor numbers from tech land remind us to look forward, not back. The great opportunities that technology created over the last quarter century are now maturing. The good news is that new opportunities will appear. They always do in a capitalistic entrepreneurial society.

Stocks rose sharply for the third straight session. It’s earnings season. Through yesterday, the results were basically in line with lowered expectations, but perhaps the biggest driver of higher stock prices was the reversals over the past several days in the value of the dollar and the yield on 10-year Treasuries. Within a bear market …

October 12, 2022- As we enter earnings season, attention will shift from interest rate fears to corporate performance. Pepsi kicked it off this morning with good results, hopefully an encouraging sign. As always, the story for the season will revolve around expectations versus reality. In July, reality beat expectations sparking the best rally of the year. The key will be the relative performance of the large tech names, notable laggards coming into earning season.

Stocks ended mixed yesterday in a very volatile session where the Dow Industrial Average moved back and forth by more than 1000 points. News was rather sparse. A brief afternoon plunge occurred after the Bank of England signaled it would halt its planned intervention to support the pound Friday as originally planned. Stock, bond, and …

October 5, 2022 – Two huge up days in a row put bulls back in charge. Is this the market bottom? Only time will tell. It will largely depend on the severity of the pending economic downturn. But retreating interest rates, and weaking labor market statistics suggest the end to the Fed’s cycle of higher interest rates is nearing an end. That is at least one key ingredient to the end of a market downturn.

For those of you who have read my letters over the years, you should know about my 2-day rule. It states that two consecutive days of outsized moves in the opposite direction of recent market trends marks a reversal. Certainly, the gains Monday and yesterday qualify as strong up sessions in sharp contrast to the …